Advertisement|Remove ads.

Seagate Analyst Calls Post-Earnings Stock Dive ‘Unwarranted’ Overreaction: Retail’s On The Same Page

Data storage devices company Seagate Technology Holdings plc.’s (STX) quarterly results, announced late Tuesday, triggered an adverse reaction from investors.

Seagate stock was down over 6% in overnight trading at last check.

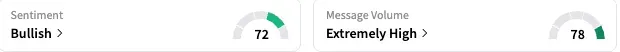

Notwithstanding the stock drop, retail watchers on the Stocktwits platform remained ‘bullish’ (73/100), with the degree of bullishness improving from the previous day. The message volume was ‘extremely high’ as retailers discussed the results.

Most watchers braced for a turnaround in the stock on Wednesday.

The stock ended Tuesday’s regular session up 1.48% at $152.68.

Segate reported adjusted earnings per share (EPS) of $2.59 and revenue of $2.44 billion for the fourth quarter of the fiscal year 2025. The results beat the Fiscal.ai-compiled consensus of $2.44 and $2.42 billion, respectively.

Seagate CEO Dave Mosely said, “Seagate’s strong FQ4 performance underscores our commitment to profitable growth, marked by a 30% year-over-year revenue increase, record gross margin, and non-GAAP EPS expanding to the top of our guidance range.”

The executive attributed the strength to the structural enhancements implemented in the company’s business and ongoing demand strength from cloud customers for its high-capacity drives.

The company announced board approval for a quarterly cash dividend of $0.72 per share, payable on Oct. 9, to shareholders of record as of Sept. 30.

For the first quarter, Seagate expects adjusted EPS of $2.30, plus or minus $0.20, and revenue of $2.50 billion, plus or minus $150 million. This compares to the consensus estimates of $2.32 and $2.53 billion, respectively.

At the midpoint, the guidance, particularly the top-line outlook, was largely in line with the consensus.

Commenting on the results, Baird analyst Tristan Gerra said Seagate continues to emphasize profitability over market share, and is on a rapid path to achieve a gross margin greater than 40%.

Heat-Assisted Magnetic Recording (HAMR), a hard drive tech designed to increase data storage capacity, remains on track to generate 40% of nearline Exa Byte (EB) shipments by the end of this year, the analyst said.

The analyst stated that the “stock overreaction” was unwarranted, with the muted revenue growth embedded in the September quarter guidance solely a result of a higher-than-usual capacity diversion to HAMR qualification.

Baird maintained an ‘Outperform’ rating on Seagate stock and also reaffirmed it as one of the firm’s “top ideas.” Gerra raised the price target for the stock to $188 from $120.

Seagate’s stock has soared nearly 80% this year, and yet the forward price-earnings (P/E) multiple is a reasonable 15.8 times. The Koyfin-compiled analysts’ consensus price target for the stock is $150.47, implying 1.45% downside potential from its Tuesday closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)