Advertisement|Remove ads.

SeaStar Medical Stock Tanks At Discounted Pricing Of Public Offering, Retail Believes Company Is Inching Closer To Bankruptcy

Shares of SeaStar Medical Holding Corporation (ICU) slumped 61% on Friday afternoon after the healthcare company announced the pricing of a public offering of over six million shares of its common stock at $0.65.

The offer price of $0.65 represents a 33% discount on the stock’s closing price on Wednesday.

The gross proceeds to the company from the offering are expected to be approximately $4 million, before deducting the placement agent’s fees and other offering expenses payable. SeaStar said it intends to use the net proceeds from the offering for general corporate purposes. The offering is expected to close on or about June 23, 2025.

SeaStar Medical is a commercial-stage healthcare company focused on treatments for critically ill patients facing organ failure and potential loss of life.

Its Quelimmune product was approved by the U.S. Food and Drug Administration (FDA) last year for the ultra-rare condition of life-threatening acute kidney injury (AKI) due to sepsis or a septic condition in critically ill pediatric patients.

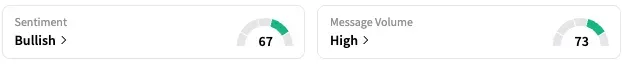

On Stocktwits, retail sentiment around SeaStar rose from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume remained ‘high’.

A Stocktwits user expressed dissatisfaction with the lack of clarity around the management’s decisions.

Another opined that the company is inching close to bankruptcy.

ICU stock is down by 81% this year and by over 93% in the past 12 months.

Read Next: Amazon Ends Same-Day Deliveries Via Kia Souls, Leans On Its Network Of Gig Workers: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)