Advertisement|Remove ads.

SeaStar Medical Stock Jumps On Safety Board Backing For Kidney Trial; Retail Eyes Another Run Despite After-Hours Plunge

SeaStar Medical Holding Corp. shares rose 7% to their highest level in more than three months on Wednesday after the company said an independent safety board had reviewed early data and recommended continuing its pivotal trial of a kidney failure therapy.

However, the stock crashed 46% in after-hours trading on Wednesday.

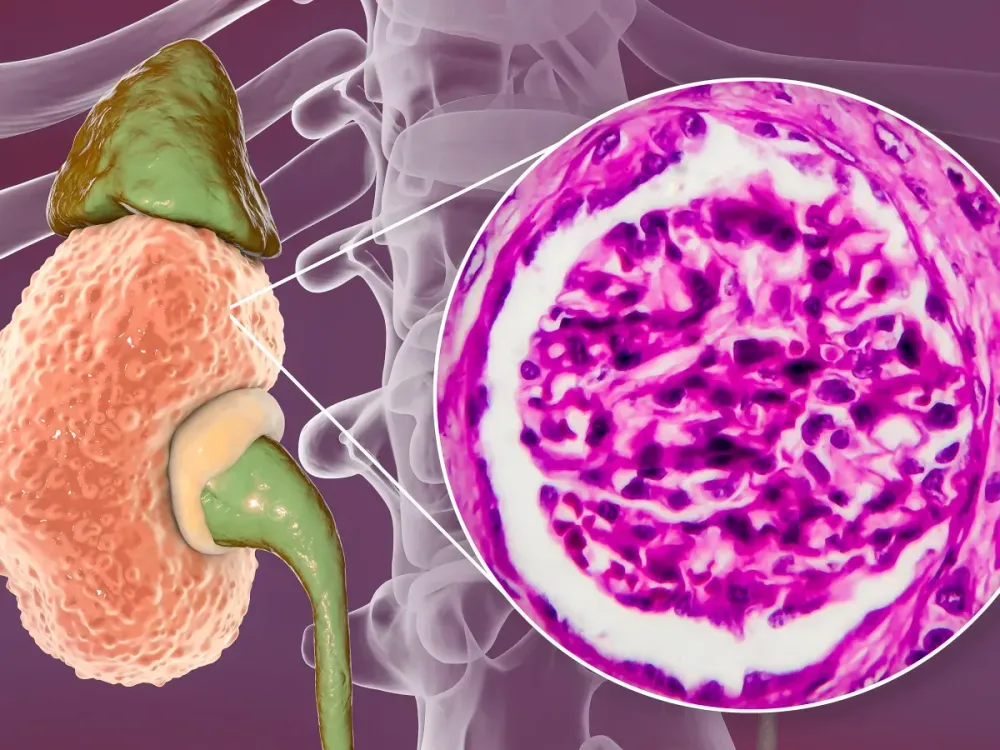

The Data Safety Monitoring Board (DSMB) conducted an interim review of the first 100 patients in the Neutralize-AKI study of the company’s Selective Cytopheretic Device (SCD) in adults with acute kidney injury requiring continuous renal replacement therapy.

The panel found no device-related safety concerns and reported zero adverse events tied to the treatment. It also flagged a signal of potential clinical benefit across key measures.

To boost the statistical power of the trial, the DSMB recommended increasing enrollment from 200 to 339 patients. SeaStar said 137 patients have already been enrolled and expects to complete recruitment near the end of 2026. The company plans to accelerate enrollment by adding new trial sites.

The Neutralize-AKI trial will measure a composite of 90-day mortality or dialysis dependency, with additional endpoints including 28-day mortality, ICU-free days, and dialysis dependency at one year. Subgroup analyses will evaluate patients with sepsis and acute respiratory distress syndrome.

SeaStar’s SCD therapy, marketed as Quelimmune, is already approved by the FDA for life-threatening acute kidney injury in children with sepsis or septic conditions. Early real-world registry data showed no safety concerns and a 75% survival rate at 28 days, suggesting a possible reduction in mortality compared with historical outcomes.

On Stocktwits, retail sentiment was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user suggested that warrant holders had timed the news to capitalize on the stock’s spike, noting they could profit as long as shares remained above their average price and questioning whether the market could absorb the additional supply.

Another user said the recent price surge was only the beginning, arguing that strong safety signals from the trial support future runs and calling any near-term pullback a buying opportunity for the long term.

SeaStar Medical’s stock has declined 36.1% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)