Advertisement|Remove ads.

Indian Solar Firms May Face Margin Squeeze If Tariff Shield Fades: SEBI RA Warns of Sunshine Trap

Indian solar panel manufacturers could be priced out of the market almost instantly if they lose government protection, according to SEBI-registered analyst Nikhil Gangil.

https://stocktwits.com/NikhilGangil/message/617501167

Gangil noted that an oversupply from Chinese manufacturers, who are flooding the global market with panels often priced below cost to offload excess inventory, has pushed solar panel prices down to just $0.08–$0.10 per watt in some regions.

In comparison, Indian solar panels still cost ₹30/W (roughly $0.36), which Gangil warns is three to four times higher and is not a competitive advantage.

Indian solar firms like Waaree Energies (WAAREEENER.NSE), Adani Green Energy (ADANIGREEN.NSE), Websol Energy System (WEBELSOLAR.NSE), and Surana Solar (SURANASOL.NSE) are ramping up production despite softening global demand and plummeting prices.

The Indian government has insulated them from weakening global demand and plummeting prices, Gangil adds.

A 40% import duty, mandatory ALMM (Approved List of Models and Manufacturers) norms, and PLI (Production Linked Incentive) subsidies have acted as a shield but these are subject to change.

If even part of this protective framework is withdrawn, Indian manufacturers could be priced out of the market almost overnight.

Gangil cautions that investors eyeing these companies as future multibaggers should be mindful of their heavy reliance on government support.

Unless Indian firms cut costs, pursue backward integration, or create true technological advantages, they’ll struggle to withstand growing competitive pressure, Gangil added.

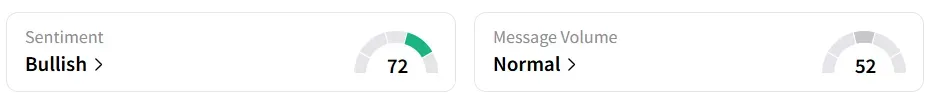

Retail sentiment for Adani Green on Stocktwits remained ‘bullish’ amid ‘normal’ message volumes.

Year-to-date as of Tuesday’s close, Adani Green stock was up 0.5%, while Waaree stock slipped 0.6%, Websol stock dropped approximately 21%, and Surana stock declined 19%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)