Advertisement|Remove ads.

‘Sell In May And Go Away?’ Most Retail Traders Prefer To Stay In The Market Despite Tariff Uncertainties

The stock market has recovered nicely from the ravages of the Trump tariffs, thanks to a strong corporate reporting season and hopes of bilateral trade deals kicking in.

After declining 0.8% in May, the S&P 500 Index — a measure of broader market performance — climbed 6.2%. Before staging a comeback, the index had dipped as low as 4,835.04 on April 7, immediately after President Donald Trump announced the ‘Liberation Day’ tariffs.

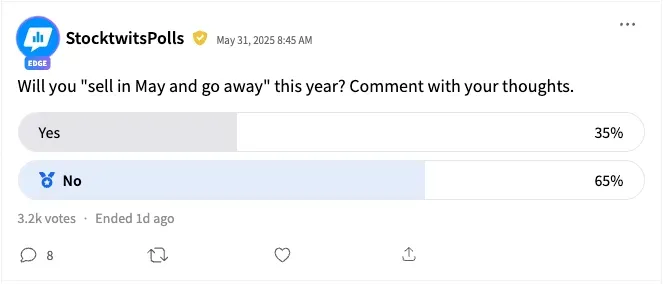

A Stocktwits poll asking users, “Will you ‘sell in May and go away’ this year?” showed that a majority (65%) replied in the negative. Only 35% said they would steer clear of the market.

The poll received responses from 3,200 users.

A user who commented on the poll said they would buy more puts, meaning they were bearish. Puts are derivative instruments that give an option to sell an underlying asset at a specified price by a specified date. They protect against any adverse move in the underlying security.

Another user said June is the new May.

The “sell in May and go away” stock market adage refers to the historical performance of stocks underperforming during the six months from May to October.

LPL Financial Chief Technical Strategist Adam Turnquist said the adage may not ring true under current circumstances. The strategist said tariff uncertainty and monetary policy can make or break the market right now.

Confounding the tariff environment, the U.S. and China have criticized each other for reneging on the initial trade agreement signed in mid-May.

Fund Strat’s Tom Lee, who has a bullish outlook, said recently that the miniature bear market in April has rebirthed a new bull market and that any dips from here would be pretty shallow.

The Invesco QQQ Trust (QQQ) ETF and the SPDR S&P 500 ETF (SPY) are up 1.7% and 0.9% this year, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)