Advertisement|Remove ads.

India Market Wrap: Sensex, Nifty Retreat After Blockbuster Rally; Pharma, Defense Stocks Buck The Trend

A day after logging their biggest single-day gain in over four years, Indian benchmarks cooled off on Tuesday as traders booked profits.

The Nifty 50 ended at 24,578, down 346 points, while the Sensex settled at 81,148, shedding 1,281 points. Both indices closed near the day's lows.

Despite the pullback in frontline indices, broader markets remained resilient. The Nifty Midcap index closed in the green, reflecting continued investor interest beyond the large caps.

Sectorally, the action was mixed. While most indices ended lower, defense, pharma, and PSU banks staged a notable outperformance.

Pharma stocks saw a relief rally, with Sun Pharma and Dr. Reddy’s gaining over 1% each, after U.S. President Donald Trump’s executive order on drug pricing was considered less stringent than anticipated.

Defense stocks also saw strong buying, buoyed by renewed commentary from the Prime Minister reaffirming the government's commitment to the 'Make in India' initiative. Bharat Dynamics (BDL) surged 11%, while Bharat Electronics (BEL) jumped 4%, making it the top Nifty gainer.

Among individual movers, Hero MotoCorp (+2%) and Cipla (+1%) rose post earnings, as investors reacted positively to the underlying growth metrics and guidance commentary.

Conversely, UPL (-5%) was the top midcap loser, tanking after its FY26 outlook failed to impress the Street.

Swiggy shares cracked 3% as the initial public offering (IPO) lock-in period ended.

IIFL gained 5% after HSBC upgraded the stock with a target price of ₹550 (42% upside), citing improved microfinance traction and better system liquidity.

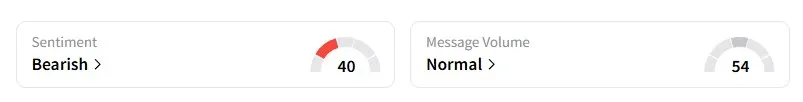

Investor sentiment around the Nifty 50 turned cautious, with a real-time sentiment tracker on Stocktwits showing a switch to ‘bearish’ as traders brace for near-term volatility following Monday's exuberance.

On the global front, European markets traded positively, while U.S. stock futures pointed to a subdued start, reflecting caution ahead of key macroeconomic data and central bank commentary.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)