Advertisement|Remove ads.

Sequans Bets Big On Bitcoin With $384M Dual-Funding Strategy: Retail Turns Exuberant

Shares of French semiconductor company Sequans Communications S.A.(SQNS) surged over 19% in Monday’s pre-market after the company unveiled a Bitcoin (BTC)-focused treasury strategy, complementing its role in the cellular IoT semiconductor market.

Sequans disclosed that it has secured commitments to raise approximately $384 million through a dual-tranche private placement of equity and convertible debt instruments.

The firm plans to allocate a substantial amount of capital to Bitcoin, framing it as a long-term strategic asset.

The initiative will be supported through a partnership with Swan Bitcoin, a U.S.-based Bitcoin infrastructure and advisory firm.

Sequans plans to raise capital through a combination of approximately $195 million from the issuance of ordinary shares and warrants, along with $189 million in secured convertible notes.

Leading the private placement effort are Northland Capital Markets and B. Riley Securities, serving as co-lead placement agents, with Yorkville Securities contributing as an additional agent.

The offering is slated to close by July 1, pending shareholder approval during meetings scheduled for June 30.

Completion of the debt component depends on the closure of the equity portion, which must reach at least $195 million in gross proceeds. Warrants from both placements become exercisable within 90 days of the closing date.

“We believe Bitcoin’s unique characteristics will enhance our financial resilience and deliver significant value to our shareholders,” said CEO Georges Karam.

Sequans has joined a growing list of companies, such as Rumble (RUM), Strategy (MSTR), and Marathon Digital Holdings (MARA), that are at the forefront of incorporating cryptocurrency into their financial planning.

Bitcoin’s price dipped as much as 1.4% to around $101,300 in Monday’s pre-market.

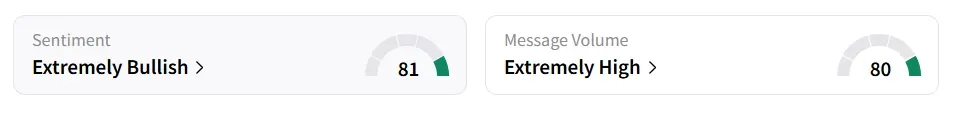

On Stocktwits, retail sentiment towards Sequans Communications improved to ‘extremely bullish’ from ‘neutral’ the previous day, with ‘extremely high’ message volume.

Sequans Communications' stock has lost over 44% year-to-date and has gained over 54% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)