Advertisement|Remove ads.

ServiceNow Stock Surges After Blowout Quarter, Bullish Retail Buzz Hits New High

Software giant ServiceNow Inc. (NOW) experienced an explosion in Stocktwits retail chatter after the company reported better-than-expected second-quarter (Q2) earnings, with CEO William McDermott highlighting the role of AI and data.

ServiceNow stock traded over 7% higher on Thursday morning.

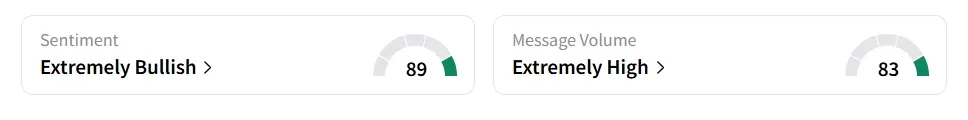

Retail sentiment toward the stock improved to ‘extremely bullish’ (89/100) from ‘neutral’ territory the previous day. Message volume jumped as well, to ‘extremely high’ (83/100) from ‘high’ levels in 24 hours.

Both retail sentiment and message volume hit a month-high. The stock experienced a 1,511% increase in message count over the last 24 hours.

Stocktwits users expressed optimism about the earnings.

“Let's talk about what's driving the growth. It's AI, data, and workflows,” said McDermott in the earnings call.

“We had 21 deals with five or more Now Assist products, and plus products were included in 18 of our top 20 deals. The AI hype cycle has not slowed for good reason.”

The earnings led to a slew of price target increases from Wall Street analysts.

BofA boosted its price target for ServiceNow from $1,110 to $1,200 while maintaining a ‘Buy’ rating, citing strong Q2 results that surpassed all major growth benchmarks, as per TheFly.

Although the projected 18% third-quarter (Q3) backlog growth aligns with the research firm’s forecast, BofA noted that management’s remarks indicate robust pipeline development through year-end, potentially driving further gains.

The company’s revenue increased 22.5% year-over-year (YoY) to $3.215 billion, surpassing the analysts’ consensus estimate of $3.12 billion, according to Fiscal AI data.

ServiceNow stock has lost over 4% year-to-date and gained over 37% the past 12 months.

Also See: A Kodak ‘Moment’? Company’s Pharma Expansion Plans Ignite 366% Surge In Retail Chatter

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)