Advertisement|Remove ads.

Shake Shack Stock Gets Price Target Hikes, Retail Cheers After Q4 Earnings Beat

Shares of fast-food chain Shake Shack (SHAK) climbed more than 11% on Thursday after the company announced a fourth-quarter earnings beat driven by “broad-based strength” across its business, lifting retail sentiment.

Earnings per share came in at $0.26, beating consensus expectations of $0.25. It posted operating income of $10.2 million for the quarter.

Same-store sales (SSS) grew 4.3% year-over-year while revenue grew 14.8% to $328.7 million, roughly in line with estimates.

“Our SSS% trends held in January despite the approximate 150 – 200 bps impact from weather and the Los Angeles wildfires, and we have confidence in our strategies to drive continued sales and profitability growth this year,” said Rob Lynch, CEO of Shake Shack.

Lynch noted the company opened 76 new outlets worldwide in 2024 and aims to expand its operated footprint of at least 1,500 “Shacks.”

Shake Shack’s Q4 saw “broad-based strength across the business” due to strategy execution around growing sales and improving operations, said CFO Katie Fogertey, adding the company’s guidance for this year and the next three years is aimed at maintaining its growth, said Fogertey.

“In 2025, we expect to execute on another great year of mid-teens sales growth, to open approximately 85 Shacks system-wide, to expand our restaurant-level profit margin to approximately 22%, and drive Adjusted Ebitda growth of 17% to 22%,” added Fogertey.

For Q1 2025, Shake Shack expects 2.5% and 3.5% in same store sales growth. Revenue is expected between $326.5 million and $330.9 million.

For 2025, it expects same-store growth of over 3% and revenue between $1.45 billion and $1.48 billion.

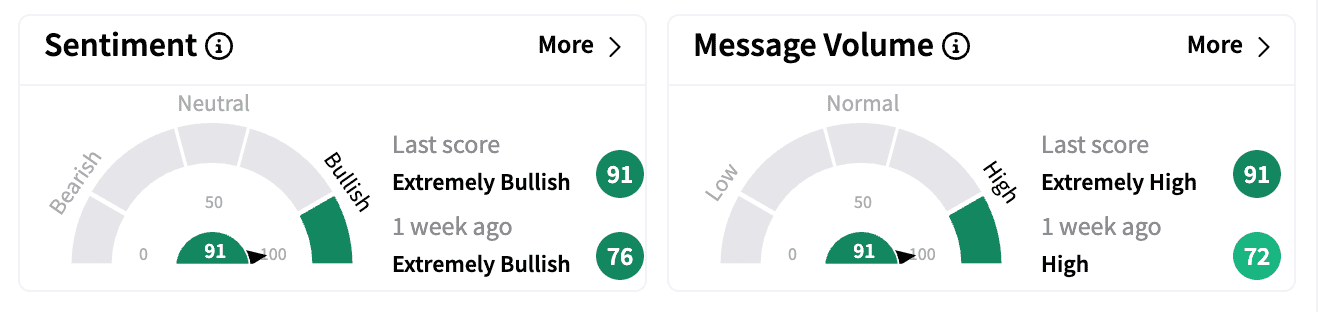

Sentiment on Stocktwits inched up in the ‘extremely bullish’ territory compared to a week ago. Message volume jumped to ‘extremely high’ from ‘high’.

One Stocktwits commenter termed the company a ten-year “buy-and-hold.”

Following the earnings, Truist raised the price target on Shake Shack to $154 from $143 with a ‘Buy’ rating, The Fly reported. According to the firm, the restaurant chain’s same-store sales momentum despite several headwinds are "a strong indication" of its solid positioning and drivers. Morgan Stanley and Stifel also raised their respective price targets by $3 and $10.

Shake Shack recently made several changes to its leadership team as part of its next phase of growth – it promoted Steph So, a senior vice president, to chief growth officer and named Luke DeRouen chief communications officer.

Since the original Shake Shack opened in 2004 in New York’s Madison Square Park, the company has expanded to over 570 locations system-wide, including over 370 in 34 U.S. States and the District of Columbia, and over 200 international locations.

Shake Shack stock is down 4.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)