Advertisement|Remove ads.

Shift4 Payments Stock Sinks On $2.5B Deal To Buy Global Blue, But Retail Bulls Aren't Fading

Shift4 Payments (FOUR) stock fell 10.7% after the bell on Tuesday after the company agreed to buy financial technology firm Global Blue in a deal valued at $2.5 billion.

The company will acquire Global Blue for $7.50 per share in cash, which implies a 15% premium to Global Blue’s closing share price as of Feb. 14.

“Integrating Global Blue into our unified payments platform positions Shift4 as a leading unified commerce payment provider around the world,” Shift4 President Taylor Lauber said.

Shift4 said Global Blue’s tax refund and currency conversion capabilities would enhance the end-to-end experience for its merchants.

The company added that Global Blue shareholders Ant International, a part of the Alibaba Group, and Tencent are exploring strategic partnerships with Shift4 and plan to remain shareholders in the combined business.

Shift4 would use its own cash and a $1.8 billion loan facility to finance the deal, the company said. The transaction is expected to close in the third quarter.

Separately, the company reported adjusted earnings of $1.35 per share for the fourth quarter, which topped Wall Street’s estimate of $1.15 per share.

The company reported end-to-end payment volumes of $47.9 billion, a 49% rise compared to the year-ago quarter.

Shift4 forecast 2025 volumes to be between $200 billion and $220 billion and projected adjusted earnings before interest, taxes, depreciation, and amortization between $830 million and $855 million.

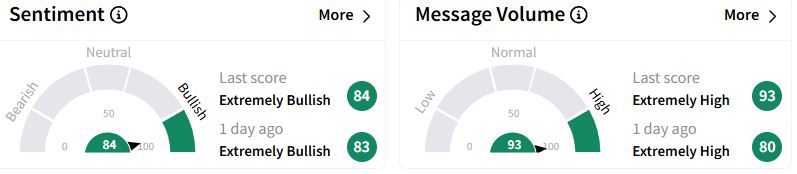

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (84/100) territory than a day ago, while retail chatter remained ‘extremely high.’

Over the past year, Shift4 stock has gained 64%.

Shift4’s CEO, Jared Isaacman, has been picked by U.S. President Donald Trump to lead NASA.

Also See: Occidental Petroleum Stock Falls After Q4 Revenue Miss, Retail Sees Buying Opportunity

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)