Advertisement|Remove ads.

Occidental Petroleum Stock Falls After Q4 Revenue Miss, Retail Sees Buying Opportunity

Occidental Petroleum (OXY) shares fell 1% after the closing bell on Tuesday as the company’s fourth-quarter revenue fell short of Wall Street’s estimates.

The company reported quarterly revenue of $6.84 billion, a 9% decline compared to the year-ago quarter. According to Koyfin data, analysts expected the company to post revenue of $7.14 billion.

However, on an adjusted basis, the company reported earnings of $0.80 per share, compared with Wall Street’s expectations of $0.67 per share.

Its average worldwide realized crude oil prices declined by 7% from the prior quarter to $69.73 per barrel. This was offset by a rise in natural gas liquids and natural gas prices.

Its midstream and marketing segment reported a net loss of $134 million during the reported quarter, compared to a profit of $182 million in the previous year.

The company’s fourth-quarter production soared to a record 1.46 million barrels of oil equivalent per day (boepd), compared with 1.23 million boepd last year.

Occidental had completed its $12 million deal for CrownRock last year, which boosted its output from the prolific Permian basin.

The company agreed to sell non-core assets in the Rockies and the Permian in two separate deals, which would help it receive a total of $1.2 billion in divestment proceeds.

Occidental had been looking to reduce its debt, which it took following the CrownRock deal and its 2019 purchase of Anadarko Petroleum.

Warren Buffett’s Berkshire Hathaway helped finance the Anadarko deal by investing $10 billion in Occidental. The conglomerate currently has a 28% stake in the oil and gas producer.

The company also raised its quarterly dividend by 9%.

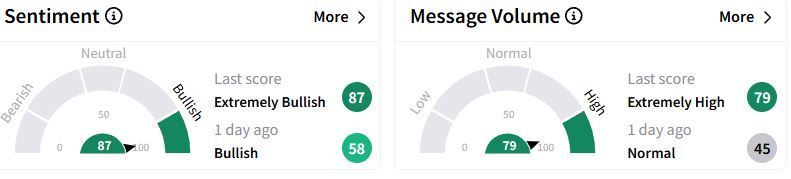

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (87/100) territory from ‘bullish’(58/100) a day ago, while retail chatter rose to ‘extremely high.’

One user felt this was the right time to build a new position in the stock.

Over the past year, Occidental shares have fallen 19.3%.

Peer Devon Energy also topped quarterly profit estimates on Tuesday.

Also See: BP Reportedly Mulls Castrol Lubricants Sale, But Retail’s Not Too Enthused

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Door_Dash_jpg_1088720ba5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_thiel_OG_jpg_9d74d987ca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)