Advertisement. Remove ads.

Retail Turns ‘Bearish’ On Paramount Stock After Report Of Skydance’s Threat Over Bronfman Deal Talks

Shares of Paramount Global (PARA) experienced a slight uptick on Friday following a media report that said Skydance Media, an initial suitor for the company, is demanding that Paramount cease its deal negotiations with Edgar Bronfman Jr.

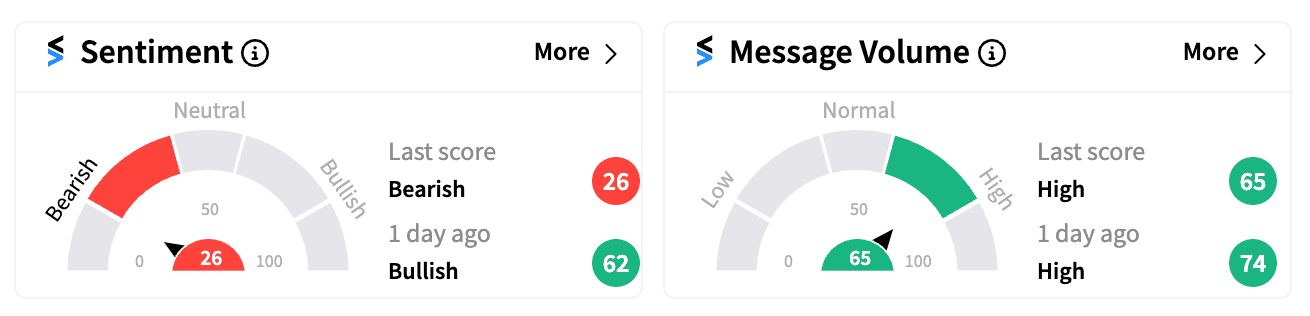

The news has led to a significant shift in retail sentiment on Stocktwits, with PARA's sentiment turning ‘bearish’ (26/100) from ‘bullish’ in just a day.

Skydance's move stems from Paramount's extension of the "go-shop" deadline to Sept. 5, a move that Skydance reportedly argues violates the terms of their existing takeover agreement.

In a letter from its lawyers, Skydance stated that while they are not currently exercising their right to terminate the agreement, they reserve the option to do so in the future.

Paramount's decision to extend the deadline came after it received Bronfman's revised $6 billion offer for National Amusements and a minority stake in the entertainment giant.

Skydance, however, reportedly contends that Bronfman's bid is not superior and therefore does not justify the extended deadline.

David Ellison's company, Skydance, had previously agreed to a deal with Shari Redstone worth more than $8 billion, involving the acquisition of National Amusements and the merger of Skydance with Paramount.

Bronfman, on the other hand, is arguing that his proposal is more attractive as it would result in less dilution for non-Redstone shareholders of Paramount.

On Stocktwits, popular posts from users on PARA's stream have leaned towards supporting Bronfman's bid over Ellison's.

Some users have highlighted the significant dilution that would occur under Ellison's plan while noting the financial backing Bronfman has secured from prominent investors.

Bronfman's investor group reportedly includes Fortress Investment Group, Jeff Ubben's Inclusive Capital Partners, and, according to Reuters, has removed cryptocurrency entrepreneur Brock Pierce and Kazakhstan investor Nurali Aliyev.

PARA's stock has faced challenges this year, losing over 20%, as consumer viewing habits shift towards streaming services.

Earlier this month, Paramount reported an 11% drop in total revenue in the second quarter and expects a $300 million to $400 million restructuring charge in the third quarter.

Following Paramount's Q2 report, Citigroup lowered its price target on the stock to $13 from $14 while maintaining a ‘Buy’ rating. Citi noted that while earnings beat market expectations, revenue fell short.

See Also: CAVA Stock’s Retail Following Jumps Most After Upbeat Q2 Results, But Sentiment ‘Bearish’

/filters:format(webp)https://news.stocktwits-cdn.com/large_generic_thread_textile_image_jpg_74c55aaaf1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_astral_4b1042f45b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trading_Floor_2_jpg_779bc9d8d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_resized_vodafone_idea_image_jpg_9f1805a814.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2020/04/NAB.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)