Advertisement|Remove ads.

SLB Stock Declines After Q3 Earnings Report: Retail Remains Resilient

Shares of the world’s largest oilfields services company SLB ($SLB) fell over 4% on Friday after the firm reported its third-quarter results that saw revenue fall short of estimates.

Revenue rose 9% year-on-year (YoY) to $9.16 billion in Q3 compared to Wall Street estimates of $9.3 billion. Earnings per share (EPS) stood at $0.89 versus an estimate of 0.88. Meanwhile, net income attributable to SLB rose 6% YoY to $1.19 billion during the quarter.

CEO Olivier Le Peuch said the firm’s earnings growth and margin expansion came in line with its full-year adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margin goal of 25% or higher. SLB posted an adjusted EBITDA margin of 25.6%, registering a 55-bps sequential increase.

“These results were achieved by our ongoing focus on cost optimization, greater adoption of our digital products and solutions, and the contribution of long-cycle projects in deep water and gas,” he said.

The CEO also noted that revenue grew in the Middle East and Asia and offshore North America but was offset by a decline in Latin America, while Europe & Africa held steady.

During the quarter, the company repurchased 11.3 million shares of its common stock for a total purchase price of $501 million. Meanwhile, the board has approved a quarterly cash dividend of $0.275 per share of outstanding common stock, payable on Jan. 9, 2025.

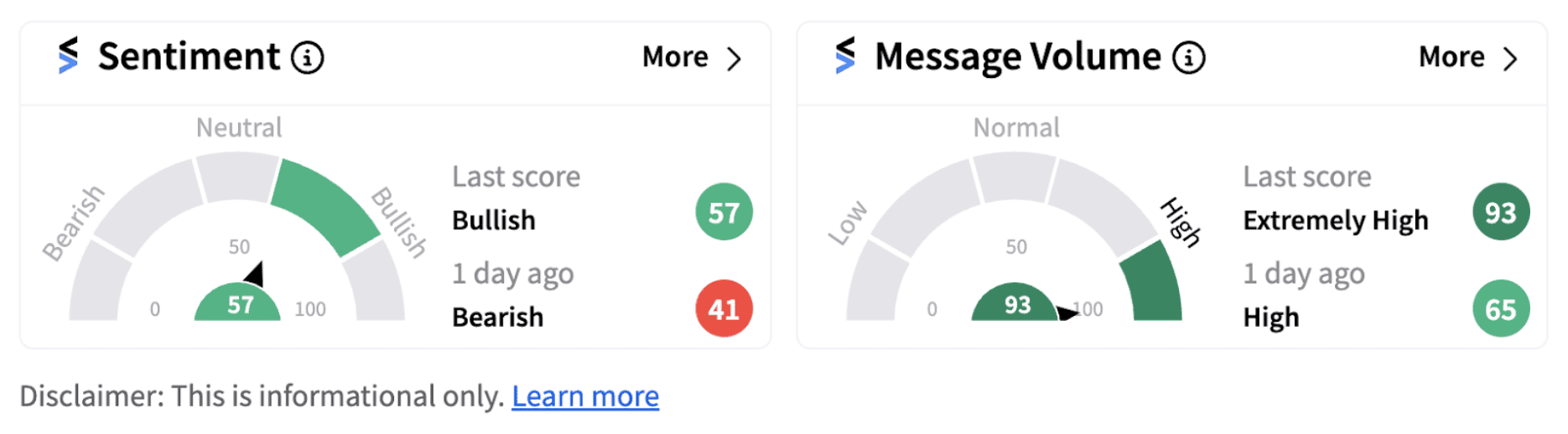

Following the announcement, retail sentiment on Stocktwits flipped into the ‘bullish’ territory (57/100) from ‘bearish’ a day ago, accompanied by ‘extremely high’ message volumes.

Stocktwits users with a bullish outlook on the firm are expressing optimism on the stock with some choosing to buy on dips.

Shares of SLB have lost over 18% since the beginning of the year.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/gsk_resized_jpg_00efc66e77.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_GE_Aerospace_resized_a883195e2c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_threads_resized_jpg_e588a33209.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/02/pulses-fao.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Albemarle_jpg_770d10f547.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)