Advertisement|Remove ads.

Solid Biosciences' Retail Following Swells Amid Stock's Best Run In A Year — What's Behind The Move?

Solid Biosciences Inc. (SLDB) shares surged more than 31% on Tuesday, their best session since January 2024, and extended gains in after-hours trading. On Stocktwits, the ticker's retail followers jumped by 11%.

Early-stage data from the company's gene therapy candidate SGT-003 for Duchenne muscular dystrophy (DMD) showed encouraging results.

Interim 90-day biopsy data from the Phase 1/2 trial showed:

- 110% average microdystrophin expression (via western blot) in the first three participants

- Improvements in multiple biomarkers, indicating better muscle health and resilience

- SGT-003 was well-tolerated, with no serious adverse events or signs of major complications like thrombotic microangiopathy

Adverse events included nausea, vomiting, fever, and transient platelet declines—which the company said were typical for adeno-associated virus gene therapy—but none required additional immunomodulatory treatments.

Following the data, according to The Fly, Chardan raised its price target on Solid Biosciences to $16 from $15, implying more than a 200% upside from Tuesday’s close.

The research firm also increased the therapy's probability of success to 48%, citing strong early efficacy signals and manageable safety.

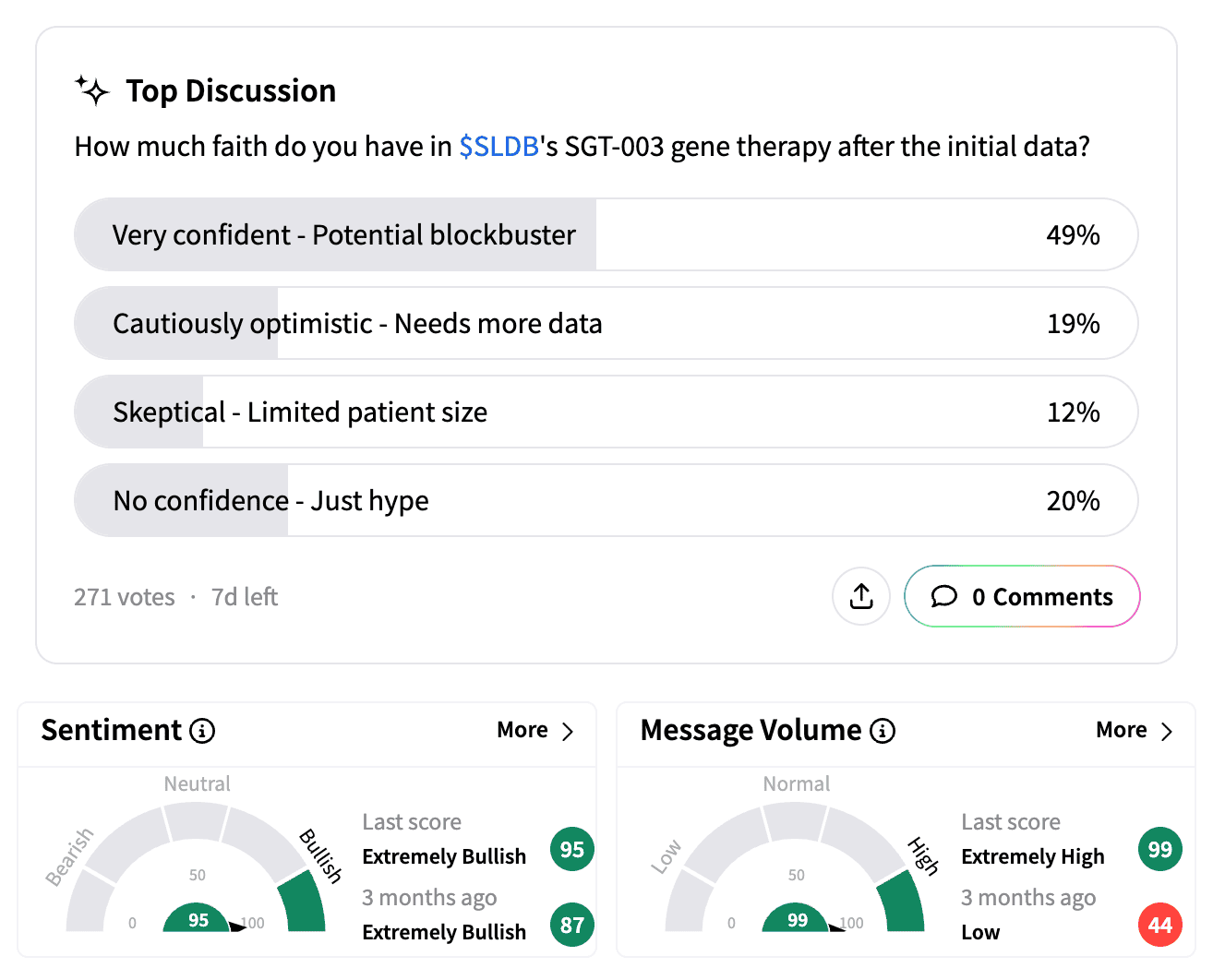

Retail sentiment on Stocktwits turned 'extremely bullish,' with message volume skyrocketing over 5,500% to the highest level in three months.

One user commented that the "real appreciation" for the stock will start "once the day traders leave."

Another suggested the stock could "double in no time" based on "pretty compelling data."

Early results from a Stocktwits poll showed 49% of respondents believe SGT-003 could be a blockbuster, while 20% think it's "just hype."

Separately, Solid Biosciences announced a $200 million underwritten offering, pricing 35.7 million common shares at $4.03 per share and 13.9 million pre-funded warrants at $4.029 apiece. The offering is set to close on Wednesday.

According to Koyfin, short interest on SLDB has climbed from 4.4% at the start of the year to 6.6%.

Solid Biosciences stock is now up over 31% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)