Advertisement|Remove ads.

SLMT Stock Jumps After Announcing First Solana Validator In UAE, Acquisition Plans

- Solmate said that its Solana validator has been assembled and is now being tested using SOL tokens purchased at a discount.

- The company also stated that it plans to pursue acquisitions along the Solana ecosystem to expand its business.

- CEO Marco Santori emphasized that these acquisitions are strategic and growth-focused, not just for revenue.

Solmate Infrastructure (SLMT) shares jumped in pre-market trade on Thursday after the company revealed that it has selected a data center in the United Arab Emirates (UAE) to host its first Solana (SOL) validator and announced plans to pursue acquisitions along the Solana ecosystem to expand its business.

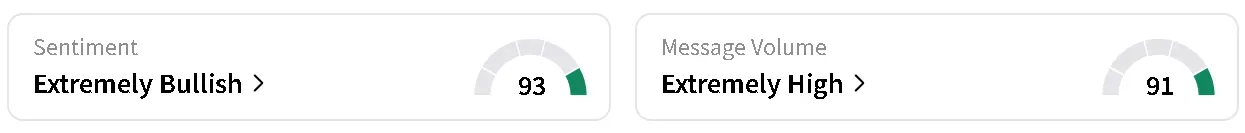

SLMT’s stock jumped as much as 47% in early morning trade, with retail sentiment on Stocktwits around the company trending improving to ‘extremely bullish’ from ‘bullish’ over the past day, as chatter jumped to ‘extremely high’ from ‘normal’ levels. According to platform data, message volume around Solmate’s shares jumped 770% in the last 24 hours, as of Thursday morning. SLMT’s stock was also among the top trending tickers on Stocktwits at the time of writing.

Meanwhile, Solana’s price gained 2% in the last 24 hours, with retail sentiment trending in ‘bearish’ territory amid ‘low’ levels of chatter.

One retail investor on the platform predicted that SLMT’s price could rally to $16 pre-market. It is currently trading just under $12.

Another trader said that Cathie Wood’s Ark Invest would likely sell its 11.5% stake in Solmate once the share price hits $20.

Planned M&A Strategy

Solmate said that its Solana validator has been assembled and is now being tested using SOL tokens purchased at a discount. It added that once it is live, it will be the first high-performance Solana validator in the Middle East.

Solmate also stated that it plans to pursue acquisitions along the Solana ecosystem to expand its business. The company said it is targeting firms where its SOL holdings can drive growth, aiming to increase the value of SOL per share for investors. CEO Marco Santori emphasized that these acquisitions are strategic and growth-focused, not just for revenue.

“We aren’t interested in simply bolting on smaller companies to generate revenue. We are targeting businesses for which our SOL treasury will be fuel for their engine of growth – just like it is for ours – and will use that growth to accrete more SOL-per-share for Solmate investors.”

– Marco Santori, CEO, Solmate Infrastructure.

PIPE Financing Update

Solmate raised $300 million through a Private Investment in Public Equity (PIPE) deal in September, which also marked its pivot to becoming a Solana-backed digital asset treasury (DAT). The company said it has amended its registration rights agreement with investors and plans to file the related SEC registration statement by November 22, 2025.

SLMT’s stock has fallen nearly 3% this year and is down more than 27% in the last 12 months.

Read also: Bitcoin On Track To Hit $110,00 After China Says Trade Talks With US Set For Friday

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)