Advertisement|Remove ads.

SMCI Stock Hits 18-Month Low After Week-Long Selloff Amid Delisting Concerns: Retail Looks To NVIDIA Earnings For Direction

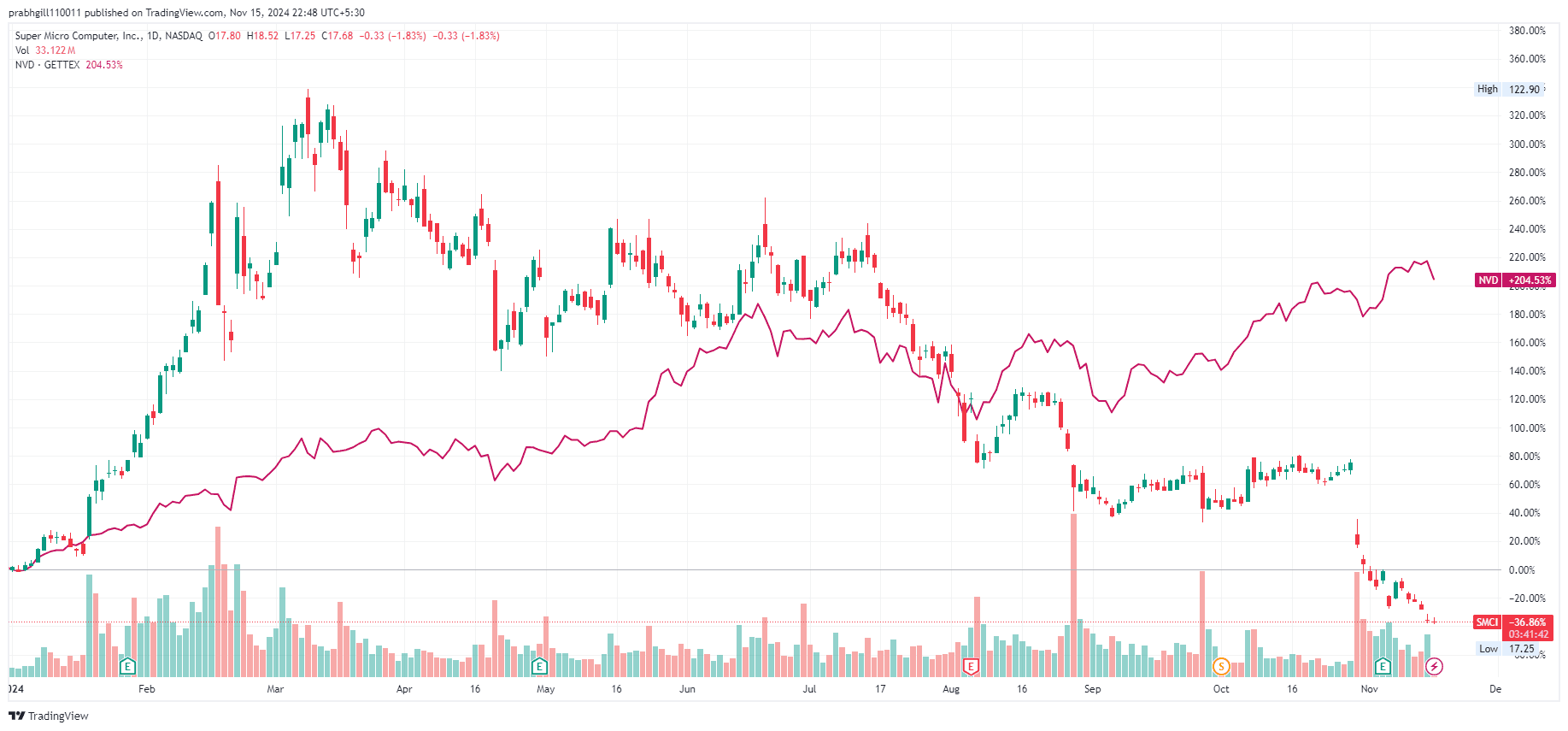

Shares of Super Micro Computer Inc. ($SMCI) dropped more than 3% in mid-day trading on Friday hitting over 1-year lows, extending a five-day losing streak as concerns over potential delisting weigh on the stock.

The company faces a Nov. 16 deadline from Nasdaq ($NDAQ) to address its overdue SEC filings, an issue stemming from accounting irregularities uncovered by Hindenburg Research in a critical short report.

Failure to meet the deadline could trigger the Nasdaq delisting process, jeopardizing SMCI’s inclusion in major ETFs and the S&P 500, leaving the stock to trade over the counter (OTC).

Cantor Fitzgerald expects Super Micro along with Moderna ($MRNA) and Illumina ($ILMN) to get delisted from the Nasdaq 100 when its annual rebalance happens on Dec. 20, it said in a research note on Friday.

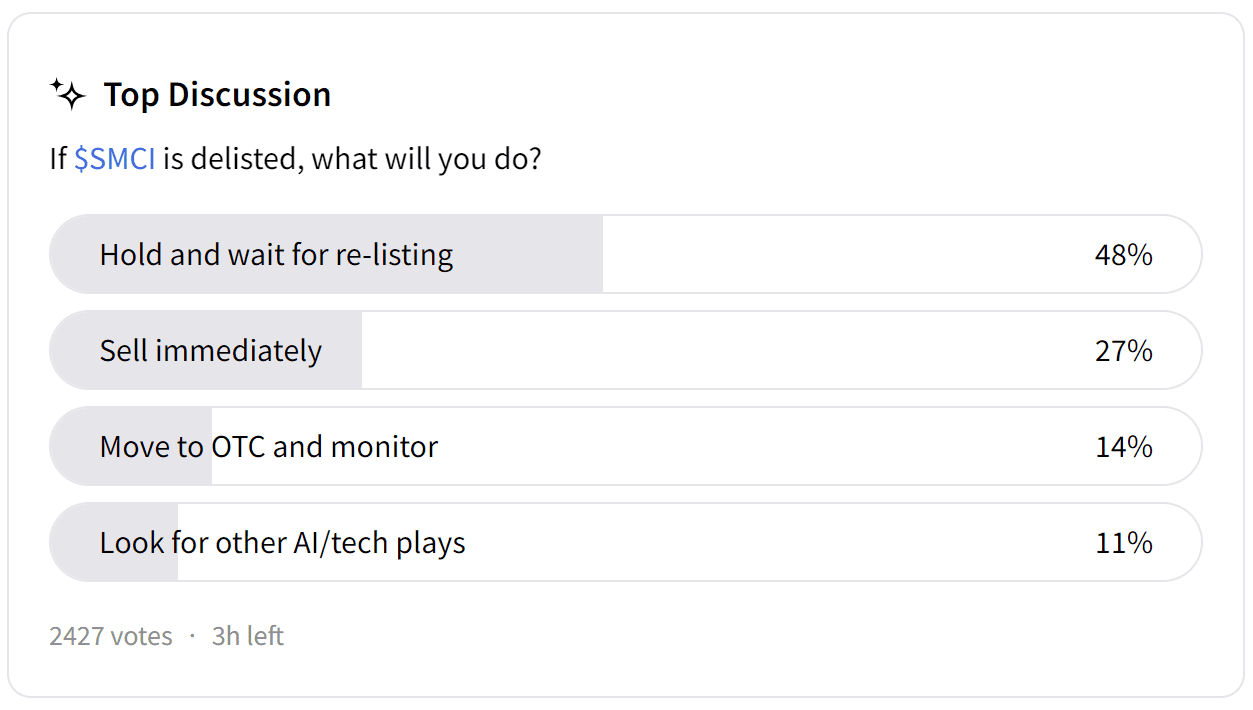

Should the stock get delisted, most retail investors will likely hold and wait for relisting, according to a poll on Stocktwits.

Others on the platform are awaiting the results of Super Micro’s appeal to the SEC for an extension.

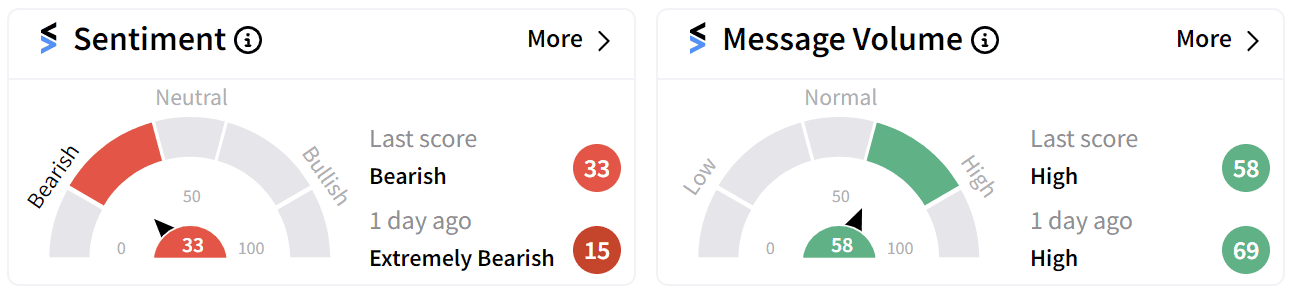

Retail sentiment on Stocktwits has improved marginally to ‘bearish’ from ‘extremely bearish’ with consistently ‘high’ chatter.

As Super Micro approaches Nasdaq’s November 16 delisting deadline, NVIDIA’s ($NVDA) upcoming earnings report on Nov. 20 has become a focal point for investors assessing the company’s future.

NVIDIA’s leadership in AI chip technology contributed to a significant rally in SMCI shares earlier this year, but that dynamic is now under question, with Super Micro’s stock falling over 37% so far this year.

Reports suggest NVIDIA may be diversifying its supply chain by redirecting server orders to other vendors, potentially distancing itself from the controversies surrounding Super Micro.

While NVIDIA has not confirmed these shifts, the risks tied to Super Micro’s accounting challenges could influence such decisions.

If NVIDIA acknowledges these reports, it could trigger further declines in SMCI shares.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)