Advertisement|Remove ads.

Summit Therapeutics’ Retail Chatter Explodes As Pfizer Trial Pact Drowns Out Q4 Letdown

Summit Therapeutics, Inc. shares rebounded in after-hours trading on Monday after a 14% selloff during regular hours, with retail sentiment surging on news of a major clinical trial collaboration with Pfizer.

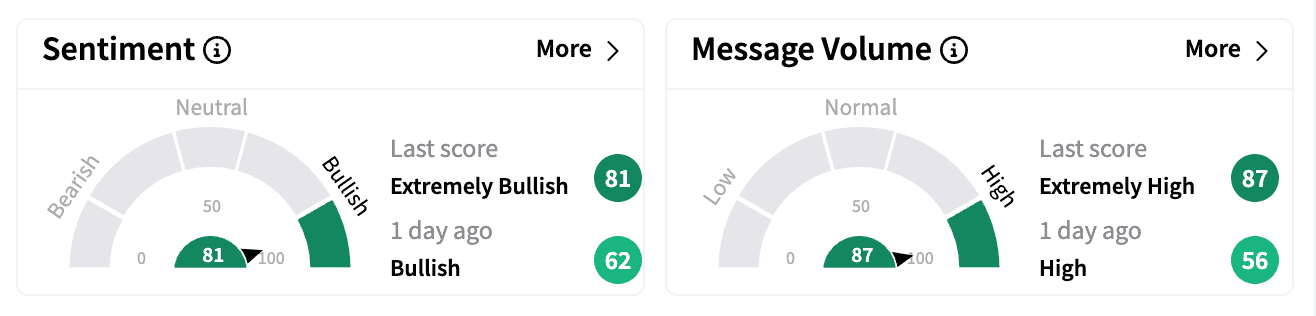

Following disappointing fourth-quarter earnings, chatter on Stocktwits jumped 2,500% as retail traders shifted focus to Summit’s partnership to evaluate its lead cancer therapy candidate in combination with Pfizer’s antibody-drug conjugates (ADCs) for solid tumors.

Summit reported a Q4 net loss of $61.1 million, slightly wider than analysts’ estimate of $60.54 million. Adjusted loss per share of $0.07 was worse than the expected $0.06 loss and wider than $0.04 a year earlier.

Adjusted operating expenses doubled to $54.8 million.

While these numbers led to an initial selloff, the Pfizer collaboration shifted sentiment.

As part of their collaboration, Summit will provide ivonescimab — a PD-1/VEGF bispecific antibody — while Pfizer will run the studies, which are expected to begin in mid-2025. Both companies will oversee the trials but retain full rights to their respective drugs.

Stocktwits sentiment turned ‘extremely bullish’ following the announcement, with many seeing Pfizer’s involvement as validation of ivonescimab’s potential.

“I seriously doubt PFE would invest in trials unless they studied the China results and believe they are reproducible ex-China,” one user posted.

”$412 mil cash, zero debt, collab with PFE…” another noted, pointing to Summit’s strong balance sheet.

Summit ended 2024 with $412.3 million in cash and short-term investments, compared with $186.2 million a year earlier.

Summit’s stock surged in September after Phase 3 trial data from China showed ivonescimab outperformed Merck’s Keytruda in treating PD-L1-positive non-small cell lung cancer.

Last month, Truist initiated coverage of Summit with a ‘Buy’ rating, calling ivonescimab “the most clinically advanced asset in a novel class of drugs” with the potential to surpass today’s leading oncology treatments.

Truist said two pivotal U.S. and European trials are already underway, and if successful, ivonescimab could enter these markets by 2026.

The research firm also said Summit could become a takeover target for a larger biotech firm.

Summit Therapeutics stock has surged over 330% in the past 12 months and is up 4% year-to-date.

According to Koyfin data, short interest rose from 2.4% in January to 2.8% last week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)