Advertisement|Remove ads.

Summit Therapeutics Surges Pre-Market On Positive Lung-Cancer Data: Retail Street At Odds

Summit Therapeutics (SMMT) shares soared 30% pre-market Monday after the company presented data from a Phase 3 cancer-drug trial over the weekend.

The study compared its drug ivonescimab against Merck’s (MRK) Keytruda as a first-line treatment for PD-L1-positive advanced non-small cell lung cancer.

Ivonescimab showed a 5.3-month improvement in progression-free survival (PFS) compared to Keytruda, marking a potentially significant advancement in lung cancer treatment.

The trial was conducted in China among patients with advanced lung cancer, and the results are seen as a direct challenge to Keytruda’s dominance in the cancer drug market.

Merck shares fell over 2% in response before the opening bell on Monday.

The positive trial data has spurred a flurry of analyst upgrades.

H.C. Wainwright raised its price target on Summit to $30 from $16, maintaining a ‘Buy’ rating. The firm described ivonescimab as superior to Keytruda across four key disease subtypes, calling the response rate “a raw measure of ivonescimab's true power.”

Citi also raised its price target on Summit to $19 from $13, emphasizing that the company has delivered on its claims of “unprecedented” data.

The firm noted that ivonescimab’s performance exceeded nearly all clinical expectations against Keytruda, which has long been considered the “gold standard” in immunotherapy.

Citi believes Summit’s stock could continue to appreciate as the data gains visibility and investors seek exposure to a company with the potential to change global lung cancer treatment standards.

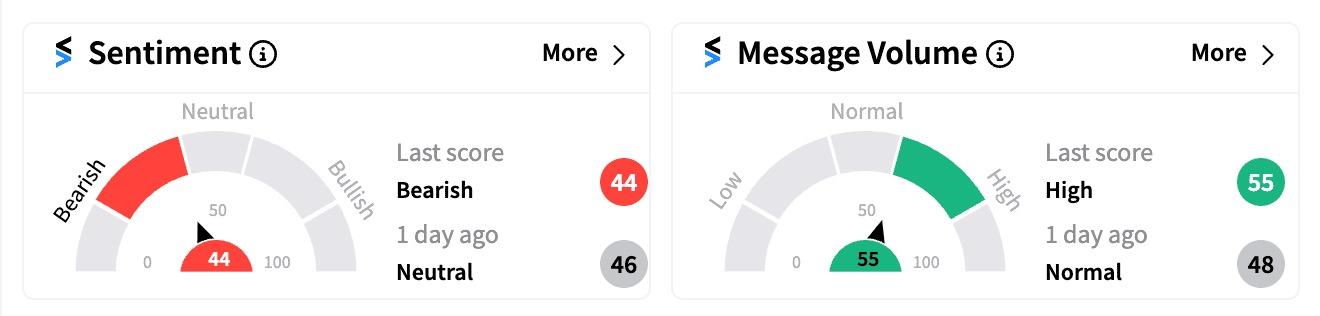

Despite the analyst enthusiasm, retail sentiment on Stocktwits slipped into ‘bearish’ levels (44/100) for SMMT, with several unconvinced of ivonescimab’s ability to dethrone Keytruda soon.

One skeptical user pointed out that Keytruda generated $25 billion in sales in 2023 and argued that Summit’s trial, conducted in “third-tier” Chinese hospitals, might not fully translate to broader markets.

Another user warned that SMMT’s price spike might not last, suggesting the company’s cash position would necessitate a capital raise soon.

Summit currently holds just $28.43 million in cash and cash equivalents as of the end of Q2 2024.

Merck’s Keytruda, approved nearly a decade ago, has been one of the most profitable cancer drugs in history, but it faces looming patent expirations and increasing competition.

Summit shares have skyrocketed 364% year-to-date, driven largely by investor excitement around ivonescimab’s potential to outperform Keytruda. In contrast, Merck shares have risen a modest 4% this year.

Read next: Boeing Stock Rebounds Pre-Market On Tentative Labor Deal: Retail Investors In Wait-And-See Mode

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)