Advertisement|Remove ads.

Snap Stock Soars Premarket After Upbeat Q3 Earnings: Retail Is Exuberant

Shares of Snap Inc ($SNAP) jumped over 10% in Wednesday’s pre-market trading after the firm posted better-than-expected third-quarter earnings.

Revenue rose 15% year-over-year (YoY) to $1.37 billion, marginally higher than a Wall Street estimate of $1.36 billion. Earnings per share came in at $0.08 versus an estimate of $0.05. Net loss narrowed to $153.25 million compared to a net loss of $368.25 million in the same period a year ago.

The firm reported a 9% rise in its daily active users to 443 million compared to an estimate of 441 million. Its Snapchat+ saw subscribers more than double to 12 million during the third quarter.

Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) improved 229% year-over-year to $132 million.

The company’s board of directors has authorized a share buyback program of up to $500 million of its Class A common stock. The repurchases will be funded from existing cash and cash equivalents. As of September end, Snap had $3.2 billion in cash, cash equivalents, and marketable securities.

CEO Evan Spiegel said the firm’s investments in AI and AR are driving innovation across its advertising platform, underpinning its long-term growth opportunity.”

During the quarter, Snap announced an expanded strategic partnership with Google Cloud to power additional generative AI experiences within My AI, its AI-powered chatbot.

“We introduced new AI-enabled features to spark conversations, make great Snaps, and discover new things, like bringing AI to Memories and improving My AI’s ability to problem solve,” the firm said.

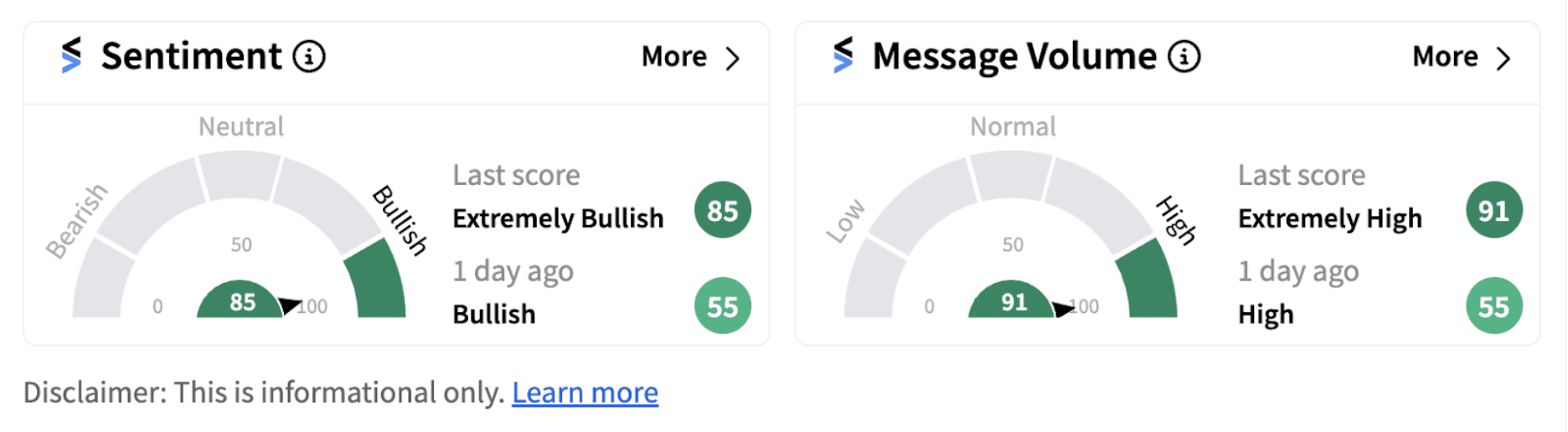

Following the announcement, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (85/100) from the ‘bullish’ zone a day ago. The move was accompanied by ‘extremely high’ message volume.

One Stocktwits user with a bullish outlook believes the stock may rally toward the $18 mark soon.

Also See: Chipotle Stock Tumbles Premarket On Mixed Q3 Earnings: Retail Stays Optimistic

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)