Advertisement|Remove ads.

SNAP Stock Is Surging Pre-Market: This Analyst Sees 70% Upside After Upgrade

- The brokerage sees early signs of progress across multiple key initiatives, including “sustained strong growth” in revenue from premium subscribers.

- The brokerage sees the planned consumer launch of Specs later this year as a potential catalyst.

- Snap had forecast revenue between $1.50 billion and $1.53 billion for the first-quarter.

Shares of Snap Inc. (SNAP) jumped 6% in pre-market trading on Thursday after a bullish analyst call, building on strong fourth-quarter results powered by momentum in its in-app optimizations segment.

If the pre-market gains hold, SNAP stock would be on track to reverse five consecutive sessions of losses. The stock closed at its lowest levels in more than seven years on Wednesday and has gained in just six of the 23 trading sessions so far this year.

Monetization Trends Are Turning, Says Analyst

B. Riley upgraded Snap to ‘Buy’ from ‘Neutral’ and kept its price target unchanged at $10, according to The Fly. This implies a 70% upside to Wednesday’s closing price of $5.9.

The brokerage sees early signs of progress across multiple key initiatives, including “sustained strong growth” in revenue from premium subscribers and traction with higher-margin advertising formats.

Snap is also trimming spending in lower-monetizing markets, analyst Naved Khan said in a research note. He sees the planned consumer launch of Specs later in 2026 as a potential catalyst and believes the stock offers an attractive risk-reward at current levels.

Q4 Earnings Show Revenue Strength, Margin Pressure

Snap posted a 10% increase in Q4 revenue to $1.72 billion on Wednesday, marginally beating Street estimates of $1.70 billion, as per Fiscal.ai data. Growth was largely driven by its In-App Optimizations segment, where revenue surged 89% due to stronger app models and wider adoption of App Power Pack.

Diluted earnings came in at $0.03 per share, rising from $0.01 a year ago but missing expectations of $0.15. Global monthly active users reached 946 million, up 6%.

For the first quarter, Snap forecast revenue between $1.50 billion and $1.53 billion, with adjusted core profit projected between $170 million and $190 million.

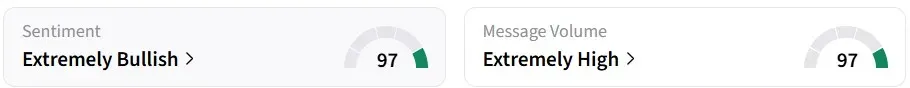

Retail Traders Turn Bullish On Stocktwits

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ zone over the past 24 hours, amid ‘extremely high’ message volumes. SNAP was among the top trending tickers on the platform at the time of writing.

One user was bullish about Snap’s advertising revenue growth.

SNAP shares have declined nearly 30% so far this year.

Read also: What Triggered AIXC Stock’s 8% Jump In Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)