Advertisement|Remove ads.

Snapchat Parent's Retail Sentiment Turns Bullish As Analyst Upgrade Boosts Stock Pre-Market

Shares of social-media company Snap, Inc. ($SNAP), which have been range-bound between $8 and $10 since early August, received a boost in Wednesday’s premarket from a positive analyst note.

JMP Securities analyst Andrew Boone upgraded the Snap stock from Market Perform to Outperform, with a $17 price target, according to The Fly.

The analyst based his optimism on an inflection in impression growth as the company benefits from imminent rollout of the Simple Snapchat and launch of Sponsored Snaps.

The new ad products will likely help the company grow its U.S. and North American engagement and drive greater advertising ad load, he added.

JMP also said its channel checks with larger performance advertisers have been favorable as the company’s direct response product improvements gain traction.

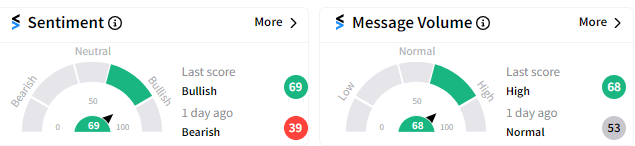

On Stocktwits, sentiment has flipped to ‘bullish,’ with a score of 69/100 as of 7: 51 am ET in premarket compared to 39/100 a day earlier. Message volume has also improved to ‘high.’

Snap is scheduled to report its quarterly report on Tuesday, Oct. 29, ahead of bigger peer Meta Platforms, Inc. ($META), which is due the following day.

Snap’s earnings may to some extent serve as a litmus test for the performance of the rest of the social-media companies.

Analysts, on average, expect the company to report earnings per share of $0.05 on revenue of $1.36 billion. according to data available on Yahoo Finance. This compares to the year-ago’s $0.02 and $1.01 billion, respectively.

In premarket, SNAP stock tacked on 2.61% to $10.24.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)