Advertisement|Remove ads.

US Energy Corp Stock Slides Pre-Market On Downbeat Q4: CEO Highlights Debt Elimination But Retail Stays Bearish

Shares of US Energy Corp (USEG) declined over 4% in Thursday’s pre-market session after the company’s 2024 earnings and revenue failed to meet Wall Street expectations.

Revenue declined 36% year-over-year (YoY) to $20.62 million compared to a Street estimate of $20.93 million. The company reported an earnings loss of $0.96 during the year, wider than an estimated loss of $0.48.

Net loss, however, narrowed to $25.78 million compared to a net loss of $32.36 million in 2023.

During the fourth quarter (Q4), total revenue stood at $4.2 million compared to $7.3 million reported in the same quarter a year ago, and an analyst estimate of $4.54 million, according to FinChat data.

The company produced 89,298 barrels of oil equivalent (Boe), or an average of 971 Boe per day (Boe/d), compared to 105,699 Boe, or an average of 1,149 Boe/d, during the third quarter (Q3) of 2024.

Oil sales were $3.6 million, and natural gas and liquids sales were $0.6 million. General adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) stood at $0.4 million.

For 2024, the company produced 415,887 Boe, or an average of 1,136 Boe/d. This compares with 624,420 Boe, or an average of 1,711 Boe/d, during 2023.

CEO Ryan Smith said that in 2024, the company eliminated all outstanding debt, optimized its legacy asset portfolio, and made significant strides in advancing the Montana-based industrial gas project.

“Looking ahead, we are focused on scaling our operations, executing new drilling and workover programs, finalizing our gas processing infrastructure, advancing our carbon sequestration initiatives, and leveraging our growing asset base to drive sustainable growth,” he said.

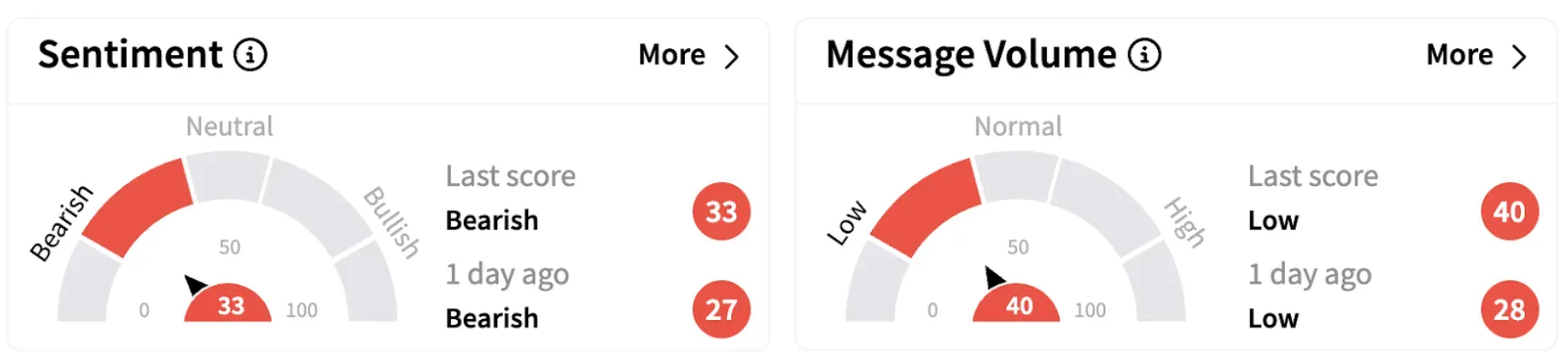

On Stocktwits, retail sentiment inched higher but continued to trend in the ‘bullish’ territory (33/100).

USEG shares have lost over 11% in 2025 but have gained 43% over the past year.

Also See: Ondas Stock Tumbles On Q4 Earnings Miss, Lower-Than-Expected Guidance – But Retail’s Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)