Advertisement|Remove ads.

SolarEdge Stock Gets A Price-Target Hike At Roth MKM Ahead Of Q4 Earnings, Rally Expected After Results: Retail Sentiment Improves

SolarEdge is scheduled to announce its Q4 results on Wednesday during after-market hours. Consensus estimates peg the company’s Q4 revenue at $189.23 million, down nearly 42% from last year's period.

The Israeli company recently announced its fourth layoff in 12 months, seeking to arrest a broader slowdown impacting the company.

Later, analysts at Morgan Stanley underscored lingering risks but highlighted that the layoffs and other strategic agreements have made them modestly positive about the company’s prospects.

Now, Roth MKM analyst Philip Shen announced a price target hike for SolarEdge stock to $17 from $12, which is also the current level at which the stock is hovering.

The brokerage reiterated its ‘Neutral’ rating on the SEDG stock ahead of Q4 earnings, noting that with so much bad news priced in, the stock could rally post-earnings.

It underscored challenges for SolarEdge in the U.S., including elevated electricity rates, Donald Trump's election, and Tesla Inc.'s Powerwall 3.

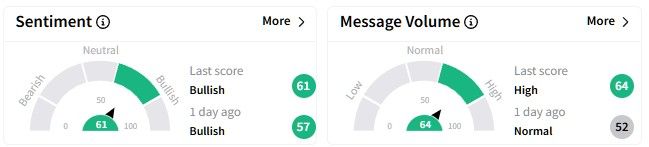

On Stocktwits, retail sentiment around the SolarEdge stock edged up, hovering in the ‘bullish’ (61/100) territory at the time of writing. Message volume picked up, too.

However, one user thinks SolarEdge’s guidance could prove to be a problem for its stock.

The SolarEdge stock closed 3.5% up on Tuesday and gained another 0.4% during after-hours trading.

However, the stock has been on a steady decline over the longer term, dropping nearly 39% in the past six months and almost 80% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)