Advertisement|Remove ads.

SolarEdge Stock On Track To Post Biggest Intraday Gain In 9 Years Despite Q4 Earnings Miss – Retail Cautiously Optimistic

Solaredge Technologies Inc. (SEDG) shares jumped as much as 27% in morning trade on Wednesday, on track for their most significant intraday jump in nearly a decade, despite reporting a quarterly loss far exceeding Wall Street’s expectations.

Despite trimming gains, the stock remains , up 23% at the time of writing.

Retail interest also surged, making it the fourth-highest trending ticker on Stocktwits.

The renewable energy company posted a loss of $3.52 per share for the fourth quarter, far exceeding the consensus estimate of a $1.50 per share loss.

Revenue, however, came in at $196.2 million, slightly ahead of analysts’ projections of $189.3 million, according to Koyfin.

The solar segment accounted for $189 million of total revenue.

Investor optimism was driven by SolarEdge’s transition to positive cash flow.

The company reported $25.5 million in positive cash flow for the fourth quarter of 2024, a sharp turnaround from the $180 million cash outflow recorded in the same period a year earlier.

The company’s revenue guidance for the first quarter also came in slightly above expectations, with the midpoint exceeding the consensus estimate of $204.3 million.

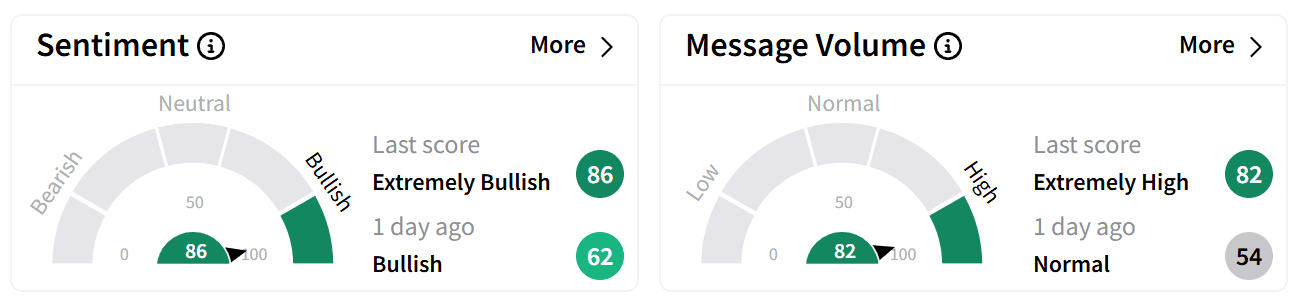

On Stocktwits, retail sentiment around Solaredge surged into the ‘extremely bullish’ territory from ‘bullish’ a day ago, with chatter increasing to ‘extremely high’ levels.

Despite the optimism, some investors voiced caution, noting that management sidestepped certain difficult questions during the earnings call.

SolarEdge shares have climbed more than 46% in 2025 but remain down nearly 20% over the past six months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tilray_Brands_jpg_add037e8e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wendy_s_resized_jpg_9b298d0aee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)