Advertisement|Remove ads.

Som Distilleries: SEBI RA Sanyam Vaish Sees Over 20% Upside After Classic Cup And Handle Breakout

Som Distilleries shares rose over 3% on Wednesday, taking its monthly gain to nearly 10%.

SEBI-registered analyst Sanyam Vaish identified a textbook ‘cup and handle’ breakout pattern in this stock.

He highlighted that Som Distilleries stock formed a 10-month cup with a slow, rounded bottom, followed by a tight handle just below ₹150, which presents a low-risk entry point. The breakout took place above its neckline with strong volumes and no overhead supply, and hence, the stock appears to have a clear upside potential. The base formation has been orderly, which shows possible accumulation by institutional investors.

Vaish recommends a swing to medium-term trade on Som Distilleries. He suggests buying between ₹160 and 164, with a stop loss at ₹148, just below the handle’s low. The upside targets of ₹180 and ₹195 indicate a potential 20-25% upside with a strong risk-reward profile.

Vaish advises traders to watch for a consolidation or retest around ₹155–160, which could offer a high-probability entry. He expects a further rally if the stock continues to show strength above ₹165 with volumes.

He considers Som Distilleries to be a strong momentum play.

Earlier in June, promoter Deepak Arora raised his stake in the company by purchasing stock via the open market. According to a filing shared on the exchanges, the overall promoter holding in the company has risen to 39%.

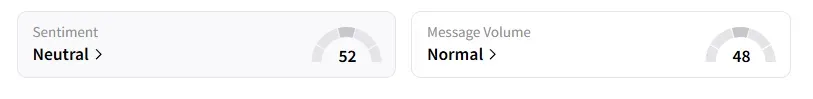

Data on Stocktwits shows that retail sentiment has remained ‘neutral’ on this counter for a month.

Som Distilleries' stock has rallied 53% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)