Advertisement|Remove ads.

Sonnet BioTherapeutics Stock Jumps 82% After Deal With Rorschach I: Retail Stays Exuberant

Shares of Sonnet BioTherapeutics, Inc. (SONN) soared on Monday after the company entered a definitive business combination agreement with Rorschach I LLC to build a reserve of HYPE, the token of the Hyperliquid Layer-1 blockchain.

SONN shares were trading 82% higher on Monday afternoon at the time of writing.

At the closing of the transaction, the newly-created entity is to be named Hyperliquid Strategies Inc. (HSI), which is expected to hold approximately 12.6 million HYPE tokens, representing $583 million in value shortly before agreement signing and gross cash invested of at least $305 million, for a total assumed closing value of $888 million.

The gross cash proceeds of $305 million at closing will enable HSI to acquire significantly more HYPE, creating one of the top strategic reserves of the HYPE token, the company said.

HSI is expected to remain listed on the Nasdaq under a new ticker symbol and become a public cryptocurrency treasury company upon the closing of the transaction.

Sonnet will operate as a wholly-owned subsidiary of HSI and will continue focusing on existing assets and business lines, including the development of its investigational cancer drug SON-1010, while disposing of other assets.

Bob Diamond, co-founder and CEO of Atlas Merchant Capital LLC, will be named Chairman of the Board, and David Schamis, CIO and Co-founder of Atlas, will be named Chief Executive Officer of HSI.

It is expected that current owners of Rorschach and other new investors at closing will own approximately 98.8% of HSI, and the legacy stockholders of SONN will own the remaining approximately 1.2%.

Raghu Rao, interim CEO of Sonnet, said that with the transaction, the company will be able to capitalize on the recent advancements around digital assets and equip Sonnet with funding to potentially realize the future value of its existing biotech assets.

Sonnet will also raise an aggregate $5.5 million in a private placement as part of the agreement, which is expected to close on July 14.

The business combination agreement is now subject to approval by Sonnet stockholders and other customary closing conditions. The closing of the business combination is expected to occur in the second half of this year.

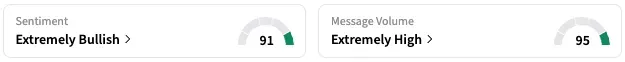

On Stocktwits, retail sentiment around Sonnet is unchanged within ‘extremely bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels.

SONN stock is up by 545% this year and by 32% over the past 12 months.

Read Next: Rivian CEO Transfers Portion Of Holdings In EV Maker To Ex-Wife As Part Of Divorce Settlement

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)