Advertisement|Remove ads.

SoundHound AI Keeps Retail Sentiment High After Vanguard Stake Build Adds Momentum To Stock Rally

SoundHound AI, Inc. (SOUN) trended on Stocktwits early Wednesday as the stock of the voice artificial intelligence (AI) company has built up some upward momentum since the start of July.

On Tuesday, SoundHound AI stock settled up 11.69% at $12.71, its highest closing level since Feb. 13. The upside came along with above-average (more than 3.5 times) volume, which lends credence to the move.

The gain came on the back of SoundHound AI’s disclosure in an amended 13G filing that Vanguard Group held a 10.10% stake in the company.

A Schedule 15G is a form that investors use when they acquire more than 5% of a company’s outstanding but are not seeking to exercise management control.

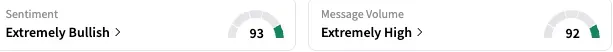

On Stocktwits, retail sentiment toward SoundHound AI stock stayed ‘extremely bullish’ (93/100) by late Tuesday, with the degree of optimism perking up from a day ago. This sentiment reading marked the highest in about a year.

The message volume also remained ‘extremely high.’ Over the 24 hours ending late Tuesday, message volume increased by over 200% compared to the previous 24-hour period.

A bullish user expected the SoundHound AI stock to rise by about 50% to $15 by the end of the month.

Another user based his optimism on Vanguard boosting its holdings by over 5 million shares. They said, “They aren't loading this to lose money……we definitely should be out of the "penny stock" tier in the next 1-2 years. This will be $30-$50 before we know it!”

SoundHound AI stock has lost about 36% year-to-date, as it traded off its Dec. 26 high of just under $25. The stock was on a strong run late last year amid deal news that continued to trickle in.

The sell-side, however, is not as bullish as retail traders. The Koyfin-compiled consensus analysts’ price target for the stock is $11.81, implying roughly 7% downside potential from Tuesday’s closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)