Advertisement|Remove ads.

SoundHound AI Stock Rallies After-Hours On Beat-And-Raise Q4: Retail Turns Bullish

SoundHound AI, Inc. (SOUN) shares rallied strongly in Thursday’s after-hours session after the conversational artificial intelligence (AI) solutions provider reported better-than-expected fiscal year 2024 fourth-quarter results and nudged up its revenue outlook for 2025.

The Santa Clara, California-based company reported a fourth-quarter adjusted loss of $0.05 per share compared to the year-ago loss of $0.04 per share. The bottom-line result was ahead of the Yahoo Finance-compiled consensus estimate of a $0.08 per share loss.

Revenue more than doubled to $34.5 million from the prior-year quarter’s $17.15 million. It also exceeded the Finchat-compiled estimate of $33.7 million.

SoundHound AI founder and CEO Kayvan Mohajer said, “We had a breakthrough year, expanding our leadership position in voice and conversational AI through major customer wins, expanded partnerships, groundbreaking generative AI innovation, and strategic acquisitions.”

The adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was a loss of $16.79 million, wider than the year-ago loss of $3.59 million, and the non-GAAP gross margin contracted by 25.8 basis points (bps) year over year to 52.1%.

It ended the quarter with a cash position of $198 million and had no outstanding debt as of Dec. 31, 2024.

SoundHound AI noted that it worked with over 30% of the top 20 quick-service restaurant (QSR) brands, and continued to expand across renowned restaurant brands. The other end markets for the company’s voice-enabled AI solutions include healthcare, automotive, retail, energy, financial services, travel and hospitality and telecom.

CEO Mohajer said the company is uniquely positioned to capitalize on agentic AI.

The company revised its fiscal year 2025 revenue outlook to $157 million to $177 million from $155 million to $175 million, surrounding the consensus estimate of $165.27 million.

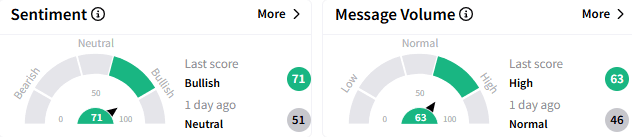

Retail investors on the Stocktwits platform were ‘bullish’ (71/100) on the SoundHound AI stock, an improvement from the ‘neutral’ mood that prevailed a day ago. The message volume perked up to a ‘high’ level. The stock was among the top five trending tickers on the platform late Thursday.

Following the earnings, a bullish watcher said the stock could be headed toward the $15+ level.

Another user highlighted the progress SoundHound AI has made with its revenue.

The stock closed the after-hours session up 8.90% at $10.03. However, it is down more than 53% year-to-date after a whopping 836% gain in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)