Advertisement|Remove ads.

SpaceX Gears Up For A Blockbuster IPO That Could Hit $1.5T And Top Saudi Aramco As The Largest Listing Ever: Report

- The company is reportedly seeking to raise more than $30 billion, with an IPO window targeted for mid-to-late 2026.

- Starlink’s fast-growing revenue is supposedly driving momentum toward a public listing.

- Internal share sales near $420 a share are reportedly helping set the valuation baseline ahead of the IPO.

SpaceX is reportedly advancing preparations for an initial public offering that would seek to raise well over $30 billion, a deal that could surpass Saudi Aramco’s 2019 float as the largest listing ever.

The company is targeting a valuation of around $1.5 trillion, placing it near Aramco’s market value at the time of its record $29 billion debut. SpaceX and its advisers are working toward a potential listing window in mid-to-late 2026, although market conditions could push the deal into 2027, according to a Bloomberg report, citing people familiar with the matter.

In recent days, SpaceX has been firming up its latest insider share sale and outlining how fresh capital would be deployed, including hiring for key IPO-related roles. The company has set a secondary-market price of roughly $420 a share, and is allowing employees to sell about $2 billion in stock while repurchasing some shares itself, the report said.

Starlink Drives Revenue Outlook Behind IPO Push

The faster path to public markets reflects the expansion of Starlink, SpaceX’s satellite-internet service, which now supports more than eight million active users across a roughly 9,000-satellite constellation. SpaceX revenue could reportedly reach $15 billion in 2025 and climb to $22 billion–$24 billion in 2026, with Starlink contributing most of the growth.

SpaceX also intends to put future IPO funds toward space-based data centers, including the chips required to run them, pointing to an effort Musk discussed publicly during a recent event with Baron Capital.

Satellite Operations

Alongside Starlink’s expansion, SpaceX is progressing on Starship, the heavy-lift rocket intended to support NASA’s lunar program. The company has deepened its government work as well, securing a $5.9 billion Space Force contract covering 28 missions through 2029 and preparing to receive about $2 billion in federal funding for the Golden Dome satellite program.

In mobile connectivity, SpaceX reached long-term spectrum agreements with EchoStar worth more than $20 billion in cash, stock and debt to support its direct-to-cell service. Musk said this month in a post on X that SpaceX has been cash-flow positive “for many years” and conducts buybacks twice annually to provide liquidity to employees and investors.

Sector Momentum

The IPO planning comes as investor interest in space companies remains strong. Rocket Lab shares have more than doubled this year, supported by 18 Electron missions in 2025 with 100% success, expanding space-systems revenue, and a backlog of $1.1 billion. The company recently said its Neutron rocket’s “Hungry Hippo” fairing has completed qualification testing and is headed to Virginia for its first launch.

How Did Stocktwits Users React?

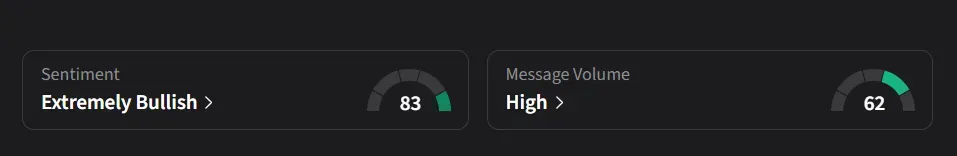

On Stocktwits, retail sentiment for SpaceX was ‘extremely bullish’ amid ‘high’ message volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)