Advertisement|Remove ads.

Spire Global Stock Tumbles 13% On $40M Private Placement Deal: Retail Mood Brightens But Still In Bearish Territory

Data and analytics firm Spire Global Inc (SPIR) shares slid 13% on Thursday after the company announced plans to raise $40 million through a private placement deal.

The company will sell five million shares of its Class A common stock at a purchase price of $8 per share and $7.9999 per pre-funded warrant. One pre-funded warrant will have an exercise price of $0.0001 per share of common stock. It will be exercisable immediately and will expire when exercised in full.

Spire said it intends to use the net proceeds from the private placement for working capital and general corporate purposes.

Last month, the company’s stock witnessed a meltdown due to concerns about the consummation of its maritime business sale to Kpler Holding SA.

According to the company, all closing conditions in the Purchase Agreement have been or could be satisfied. However, despite the company’s notice to the buyer, it failed to consummate the closing.

Spire Global expected the transaction to close in the first quarter of 2025.

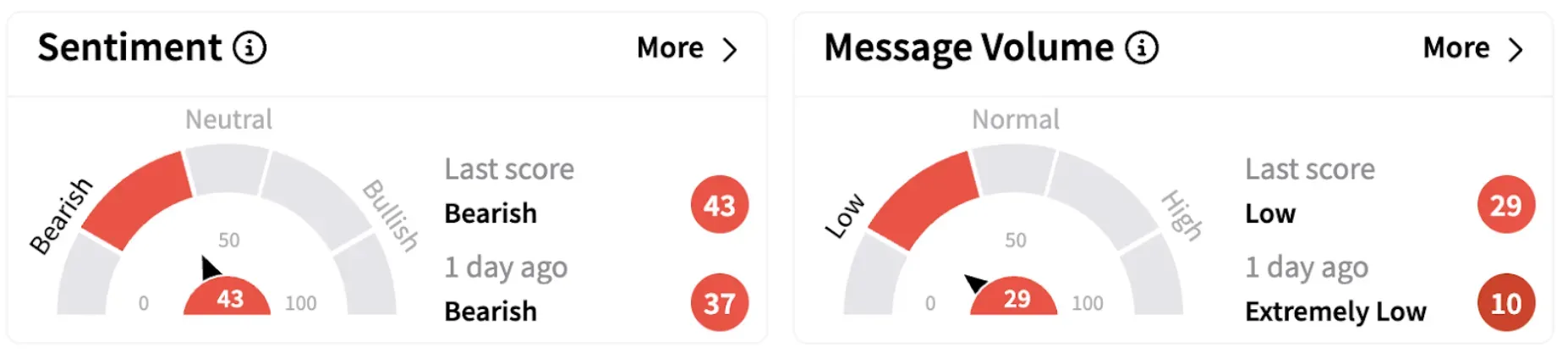

Meanwhile, on Stocktwits, retail sentiment improved marginally but continued to trend in the ‘bearish’ territory (43/100).

One user expressed skepticism about a potential (more??) dilution if the Kpler deal isn’t closed.

Another long-term investor in the stock believes the shares may be headed toward rock-bottom level.

SPIR shares have lost over 38% in 2025 and are down 26% over the past 12 months.

Also See: Barclays Reportedly Expects Fed To Go For Two Rate Cuts In 2025 Amid Softer Labor Market

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)