Advertisement|Remove ads.

Barclays Reportedly Expects Fed To Go For Two Rate Cuts In 2025 Amid Softer Labor Market

Barclays analysts have reportedly increased their 2025 rate cut expectations to two from one amid softer U.S. labor market conditions and trade policy uncertainty.

According to a Reuters report, Barclays expects two 25 basis points rate cuts each in June and September. Following the anticipated September rate cut, the brokerage expects the Federal Reserve to maintain the status quo on its policy for an extended period before resuming rate cuts in March 2026.

"We think that the relatively sharp slowdown in job gains will be accompanied by only a moderate rise in the unemployment rate, which would peak at 4.3% in October,” Barclays said.

The brokerage also noted that the June rate cut would “reflect indications of slower growth and rising unemployment,” while the September reduction would indicate “a rising unemployment rate and some signs of improvement in monthly inflation prints.”

The development comes after U.S. consumer prices rose less than expected in February. The Consumer Price Index (CPI) rose 0.2% month-on-month and 2.8% annually.

Economists surveyed by Dow Jones expected headline CPI to be 0.3% and 2.9%, respectively.

Core inflation, which excludes food and energy prices, rose 0.2% month-over-month in February and increased 3.1% over the last 12 months. Economists had expected core CPI to be 0.3% and 3.2%, respectively.

Barclays’ Fed policy prediction matches with traders’ stance, according to the CME FedWatch Tool. The latest data shows that traders are factoring in a 58.7% probability of a 25 basis points rate cut in June and a 41.3% probability of a second 25 bps rate cut in September.

Meanwhile, on Thursday, U.S. indices resumed their downtrend as investors digested the ongoing tariff threats. On Thursday, Trump wrote on Truth Social that the U.S. would retaliate if the European Union did not remove its 50% tariff on Whisky.

“If this Tariff is not removed immediately, the U.S. will shortly place a 200% Tariff on all WINES, CHAMPAGNES, & ALCOHOLIC PRODUCTS COMING OUT OF FRANCE AND OTHER E.U. REPRESENTED COUNTRIES. This will be great for the Wine and Champagne businesses in the U.S.,” he wrote.

The SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) traded down over 1% on Thursday noon.

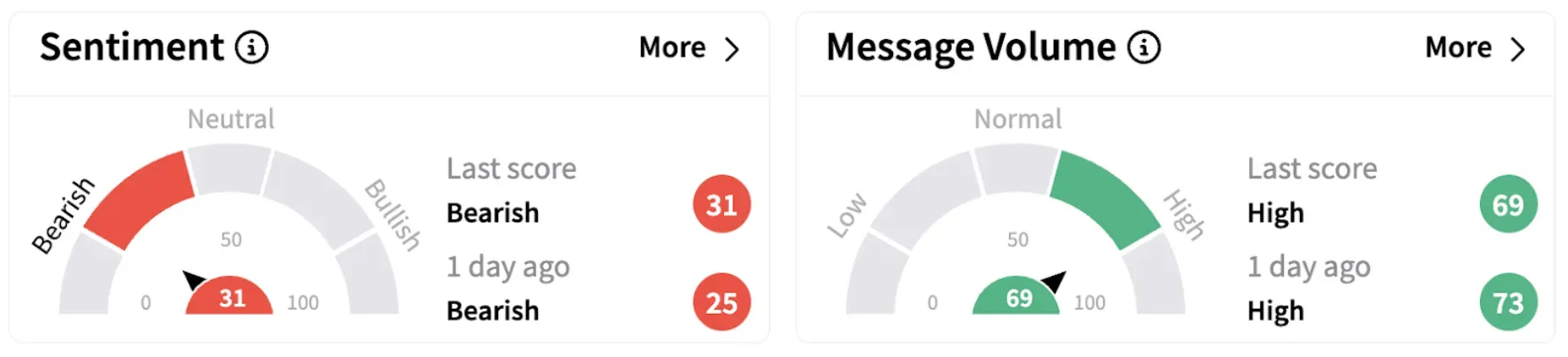

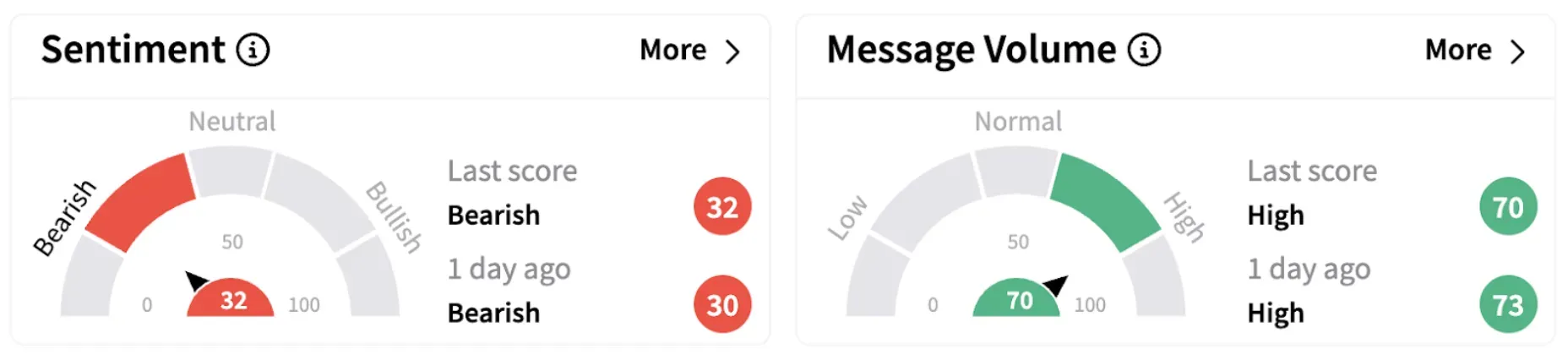

Retail sentiment for these ETFs continued to trend in the ‘bearish’ territories, albeit with an improved score.

Investors now await the Fed’s policy decision next week, which will be crucial in determining the economy’s trajectory.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)