Advertisement|Remove ads.

Spotify Analyst Bullish Ahead Of Music Streaming Services’ Q4 Results: Retail Likes High-flying Stock

Music streaming company Spotify Technology S.A. (SPOT) is scheduled to report its fiscal 2024 fourth-quarter results on Tuesday before the market opens.

Analysts, on average, expect the company to report earnings per share of $2.07, reversing from a loss of $0.36 a year ago. Revenue is expected to rise year over year (YoY) to $4.33 billion.

Spotify previously guided to revenue of 4.1 billion euros ($4.20 billion), monthly active users (MAU) to 665 million and a subscriber count to 260 million. It also said it expects a gross margin of 31.8% and an operating income of 481 million euros, pointing to its first full year of operating profit of 1.4 billion euros.

This marks an improvement from third quarter's 574 million in MAUs, 226 million in premium subscribers, and 361 million in ad-supported MAUs.

Recently, Spotify announced new multi-year agreements with Dutch-American music company Universal Music Group N.V. ($UMGNF) that envisaged the establishment of a direct license between Spotify and UMG across Spotify’s current product portfolio in the U.S. and several other countries.

Two sell-side firms upped their price targets for Spotify on Friday, TheFly reported. Canaccord Genuity lifted the price target Spotify stock to $650 from $560 and maintained a ‘Buy’ rating. The firm expects solid quarterly results from the company due to healthy subscriber growth, the ongoing benefit of recent price increases and operating leverage.

The firm also expects scope for further price increases, given Spotify’s leading competitive position and continued investments in content expansion.

KeyBanc Capital Markets increased the price target to $600 from $555 while remaining at ‘Overweight.’ The firm said the fourth-quarter results will likely underline the ongoing subscriber, revenue, and margin momentum.

With the Universal Music Group deal, Spotify can now highlight how product and plan innovation can drive revenue growth to its 20%-plus target, it added.

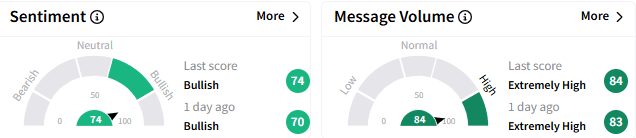

On Stocktwits, retail sentiment toward Spotify remained ‘bullish’ (74/100) and message volume stayed ‘extremely high.’

A retail watcher of the stock highlighted Spotify's stock chart showing a breakout from a recent trading range. Another was positioning for a rally going into earnings following the recent dismissal of the Mechanical Licensing Collective lawsuit for omitted royalties.

Spotify stock ended Friday’s session down 0.29% at $548.55, off its intraday high of $560.36 reached during the same session and all-time closing high of $550.13 hit on Thursday. It has gained about 22.6% in January on top of 2024’s 138% jump.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)