Advertisement|Remove ads.

Palantir Stock In Spotlight Ahead Of AI-Powered Data Analytics Company’s Q4 Results: Retail Sits Firmly On Bullish Camp

Retail sentiment toward Palantir Technologies, Inc. (PLTR) stock remains buoyant ahead of the data analytics company’s fiscal year 2024 fourth-quarter results due Monday after the market closes.

Wall Street analysts’ consensus estimates call for fourth-quarter non-GAAP earnings per share (EPS) of $0.11 and revenue of $781.24 million, according to Yahoo Finance. This compares to the year-ago numbers of $0.08 and $608.35 million, respectively, and the preceding quarter’s $0.10 and $726 million.

The guidance issued in early November modeled quarterly revenue of $767 million to $771 million and adjusted income from operations of $298 million to $302 million.

Palantir has exceeded top- and bottom-line expectations in each of the past four quarters.

When the Alex Karp-led company releases its quarterly results, investors will likely focus on its U.S. commercial revenue and commentary regarding the U.S. government revenue. The new administration under President Donald Trump is widely seen as a positive for the company, given its artificial intelligence (AI) thrust and co-founder Peter Thiel’s reported proximity to the president.

In the third quarter, U.S. commercial revenue climbed 54% year-over-year (YoY) and 14% (Q-o-Q) to $179, accounting for about 25% of the total revenue. U.S. government revenue climbed 40% YoY and 15% QoQ to $320 million, or 44% of the total.

Media reports said in December that Palantir, in partnership with privately-held defense tech company Anduril, is eying an industry-wide collaboration to jointly bid for Pentagon contracts in order to take on the oligopoly of prime contractors.

In late January, Wedbush analyst Daniel Ives upped the price target for Palantir to $90 from $75, citing increased confidence in the company’s AI strategy. “While the valuation is expensive today we see the Messi of AI as a core winner in the trillions of AI spend over the next few years,” he said.

Ives sees Palantir emerging as the next Oracle and Salesforce over the coming years. He said the Street is underestimating the potential of the company’s U.S. commercial business, which, with the aid of the proprietary AIP platform, can generate over $1 billion in revenue.

Citing Wedbush’s checks, Ives said Palantir continues to see unprecedented demand for AIP across both commercial and government landscapes.

The Wedbush analyst also flagged a one-time impact of $120 million in stock-based compensation expense to be recognized in the fourth quarter, but he sees this as a non-event.

The analyst has an ‘Outperform’ rating on the stock.

A recent Stocktwits poll showed retail users of the platform think Palantir stock is either fairly valued or positioned for strong gains.

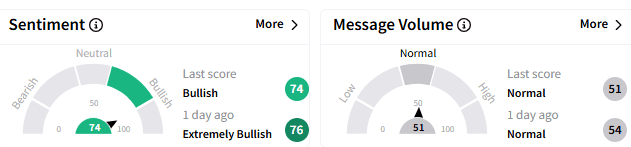

Retail sentiment toward the stock remained ‘extremely bullish’ (74/100) but message volume remained ‘normal.’

A retail watcher predicts the stock galloping toward $100. Another said they see a pullback on Monday due to the Trump tariffs but a "violent" rebound on Tuesday on earnings.

Palantir stock has resumed its uptrend since bottoming at $65.04 on Jan. 10. On Friday, the stock settled at $82.49, marking a gain of 9% in January. Palantir was a high-flier in 2024, rising 340% as investors increasingly bet on its AI prowess.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)