Advertisement|Remove ads.

Starbucks Stock Edges Lower Premarket As Profit Miss Overshadows Sales Revival

- The coffee chain reported same-store sales growth for the first time in nearly two years.

- Adjusted profit declined and missed Wall Street expectations, raising some concerns among investors.

- Topline growth was driven by a 3% rise in international sales.

Starbucks, Inc.’s shares fell 0.4% in early premarket trading on Thursday, with Stocktwits sentiment sifting higher, after the cafe chain reported same-store sales growth for the first time in nearly two years even as quarterly profit missed expectations.

Pumpkin spice drinks and foods, a hallmark of the fall season, along with better service, helped draw more customers to Starbucks cafes, particularly in overseas markets. However, higher coffee bean prices hit the company’s margins, an issue the management says will persist.

Mixed Results

Although mixed, the quarter's performance indicates some improvement from the company’s ongoing turnaround effort. Starbucks has cut staff, closed low-performing cafes, adjusted its menu, and launched several initiatives to improve the in-cafe experience under the new CEO Brian Niccol, who joined last year.

It is also close to selling a full or part of its China operations.

In its fiscal fourth quarter, Starbucks’s sales rose 1% over. Net revenue rose 5% to $9.6 billion, beating analysts’ expectations of $9.3 billion. Adjusted EPS dropped to $0.52, down from $0.80 a year earlier, and missed the target of $0.56.

International same-store sales rose 3% in the quarter, handily beating estimates of a 1.61% rise.

Niccol said the company will be “very strategic” in raising prices next year.

What Is Retail Thinking?

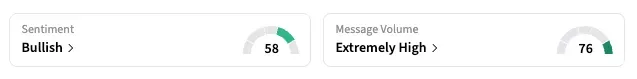

On Stocktwits, the retail sentiment for SBUX shifted to ‘bullish’ as early Thursday, from ‘neutral’ the prior day, with the 24-hour message volume for the ticker rising nearly 550%. User comments were mixed, with some optimistic about Starbucks’ turnaround and others concerned about profit declines, painting a glum picture.

“SBUX needs to be studied. For the life of me can’t figure out how this stays up. Should be down 15%,” a user said, while another user forecast that analysts will quickly dole out upgrades.

Meanwhile, Starbucks’ coffee delivery business surpassed $1 billion in sales in fiscal 2025, after growing nearly 30% in the fourth quarter. Deliveries are available through Uber Eats, DoorDash, and Grubhub in the U.S.

As of the last close, Starbucks’ shares are down 7.8% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261087084_jpg_9cdd1d104f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)