Advertisement|Remove ads.

Stellantis Stock Slides On Lowered Outlook: Retail Confidence Drops To ‘Extremely Bearish’

NYSE-listed shares of Stellantis N.V. fell nearly 13% on Monday after the European automaker revised its 2024 financial guidance, joining a bunch of peers from the continent in forecasting a dire outlook.

Stellantis said it expects its adjusted operating income (AOI) margin to come in between 5.5-7.0% for fiscal year 2024, down from its prior double-digit forecast. The firm said roughly two-thirds of the reduced AOI margin is driven by corrective actions in North America while other contributors include lower-than-expected sales performance in the second half of the year across most regions.

Stellantis also lowered its cash flow outlook to -€5 billion to -€10 billion, versus positive expectations earlier. The firm said the revised forecast primarily reflects the substantially lower AOI outlook and the impact of temporarily elevated working capital in the second half of 2024.

Stellantis said that competitive dynamics have intensified due to both rising industry supply, as well as increased Chinese competition. The firm is accelerating the normalization of its U.S. inventory levels, targeting no more than 330,000 units of dealer inventory by year-end 2024 from a prior timing objective of the first quarter of 2025..

To achieve this, it is cutting down on shipments to North America by over 200,000 vehicles and is increasing incentives on 2024 and older model year vehicles. The firm is also undertaking productivity improvement initiatives that encompass both cost and capacity adjustments.

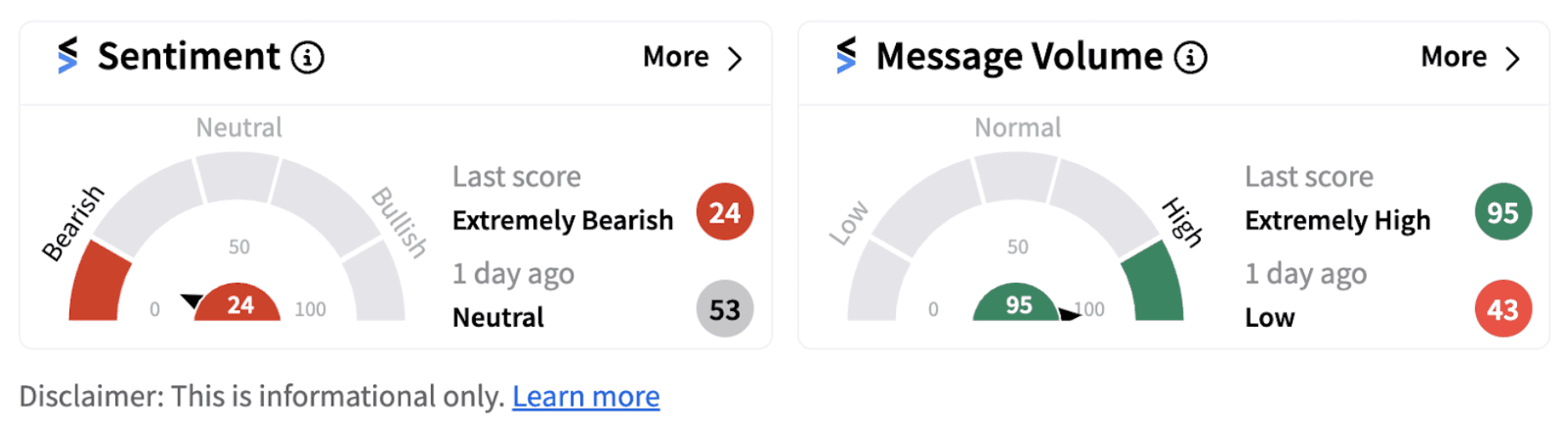

Following the update, retail sentiment on Stocktwits for Stellantis dipped into the ‘extremely bearish’ territory (24/100), accompanied by ‘extremely high’ message volumes.

One Stocktwits follower of Stellantis opined how the firm isn’t doing great on EVs.

Stellantis isn’t the only automaker to announce a revised outlook. Shares of Aston Martin Lagonda Global Holdings Plc plunged nearly 24% in London after the the luxury carmaker reportedly said it doesn’t expect a positive free cash flow in the first half and is cutting its 2024 wholesale volumes target by about 1,000 vehicles.

Meanwhile, Volkswagen shares slid nearly 2.5% after the firm lowered its operating margin guidance to 5.6%, down from a prediction of as much as 7% in July.

Also See: AT&T Offloads Remaining 70% Stake In DirecTV To TPG For $7.6B: Retail Stays Cautious

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2217651413_jpg_838cf7a8bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_walmart_OG_jpg_8a74984dc4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347001_jpg_8286032c70.webp)