Advertisement|Remove ads.

Stocktwits Poll Finds Retail Jittery Over Trump Tariffs: Most Believe They Are A ‘Market Killer’ Leading To ‘Economic Pain’

The extended bull market run seen since late October 2022 faces a key threat as President Donald Trump’s tariffs on Canada, Mexico and China sap investors’ risk appetite.

The S&P 500 traded lower for a second straight session amid the escalating tariff wars. Early Tuesday, the tech-heavy Nasdaq Composite Index fell into correction territory, defined as a 10% to 20% drop from the recent high. The index has recovered since then.

The Nasdaq 100 Index, which comprises the 100 biggest non-financial tech companies, traded down 7.7% from its Feb. 19 high.

Seven of the 11 S&P 500 sector classes were in the red on Tuesday, with IT, energy, consumer discretionary, and material stocks leading the weakness. Only defensive sectors (consumer staples, healthcare, real estate, and utility) found some buying interest.

As economists and analysts warn of the far-reaching consequences of fully implementing the Trump tariffs, sentiment among retail traders has taken a big hit. Trump has imposed a 25% tariff each on Canada and Mexico and an additional 10% tariff on Chinese imports, over and above the 10% that already went into effect.

Canada was quick with its retaliatory tariffs, and Mexico is all set to announce its response in a speech by President Claudia Sheinbaum on Sunday.

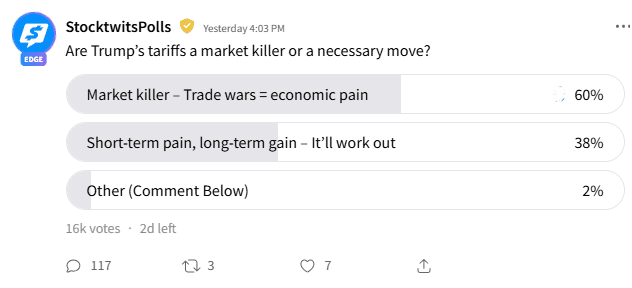

An ongoing Stocktwits poll that probed retailers on the platform regarding their view on the impact of Trump’s tariffs received responses from 16,000 users.

Of the respondents, 60% saw the tariffs as a ‘market killer’ and feared a trade war, which could lead to economic pain. Some (38%) conceded that the tariffs would cause near-term pain, but they saw these working out for the economy's good in the long run.

One of the respondents said that, let alone the markets, the collapse of the U.S. has begun.

Another user said both sides would be affected, but the U.S. would suffer the biggest hit in the long term as it loses trust with its trading partners.

Some who supported the tariffs compared them to Federal Reserve Chair Jerome Powell raising interest rates. “The market hates it, but it’s a necessary evil,” they said.

Wedbush analyst Daniel Ives hopes that the tariff talks are merely a ploy to bring trading partners to the negotiating table.

More details and clarity could be forthcoming when Trump addresses a joint session of Congress at 9:10 p.m. ET on Tuesday.

The SPDR S&P 500 ETF Trust (SPY) clawed back some of the early losses and traded down merelu 0.41% at $581.36. The SPY ETF is down about 0.40% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Sandisk Analyst Predicts Nearly 70% Upside For Relisted Stock: Retail’s Excited

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lockheed_Martin_jpg_8c751d0020.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)