Advertisement|Remove ads.

Trump Tariffs: Analyst Says 'Uncomfortable Time' For Growth Investors But Not The ‘Time To Run For Hills In Tech Trade’

Donald Trump walked the talks and has confirmed that the 25% tariffs on Mexico and Canada and an additional 10% tariff on China will go into effect on Tuesday.

Canadian Prime Minister Justin Trudeau said the country will match Trump’s 25% rate on $107 billion in U.S. goods. Meanwhile, Mexican President Claudia Sheinbaum said her government will impose “tariff and non-tariff measures” and detail the measures in a public speech on Sunday.

In a note released Tuesday, Wedbush analyst Daniel Ives discussed the potential fallout for growth-oriented tech stocks.

The analyst said the tariffs on Canada, Mexico, and China will be a major pain for U.S. consumers and the country's economic foundation. The analyst added that the tariffs could be a “game of high-stakes poker” to bring these countries to the negotiating table.

The analyst noted that with artificial intelligence (AI), the world is in the midst of the biggest tech transformation trade since the industrial revolution. He sees $2 trillion in AI capital expenditure over the next three years.

Ives said, “Tariffs and policy are not changing that…they could slow the spots down in the near term.”

Among the tech stocks he recommended owning amidst the tariff overhang are:

- Apple, Inc. (AAPL)

- Alphabet, Inc. (GOOG) (GOOGL)

- Microsoft Corp. (MSFT)

- Amazon, Inc. (AMZN)

- Nvidia Corp. (NVDA)

- Tesla, Inc. (TSLA)

- Palantir Technologies, Inc. (PLTR)

- Salesforce, Inc. (CRM)

The analyst’s preference for these stocks is premised on the demand trends.

Ives said, “This will be an ‘uncomfortable time for growth investors’....but ultimately this is not the time to run for the hills in the tech trade and instead overn these tech AI winners.”

Meanwhile, Morgan Stanley economists expect a meaningful impact if tariffs are fully implemented. They expect U.S. inflation to tick up by 0.3 to 0.6 percentage points over the next three to four months and GDP growth to fall by 0.7-1.1 percentage points from the baseline scenario.

The firm’s equity strategists named IT hardware and equipment, autos, and consumer subsets as the sectors most at risk.

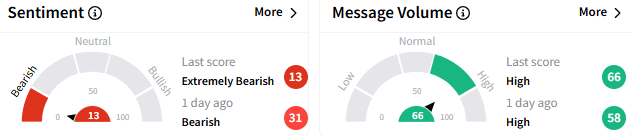

On Stocktwits, sentiment toward Invesco QQQ Trust ETF (QQQ) turned to ‘extremely bearish’ from the ‘bearish’ mood that prevailed a day ago. The message volume stayed ‘high’ as retail deliberated the fallout from the tariff imposition.

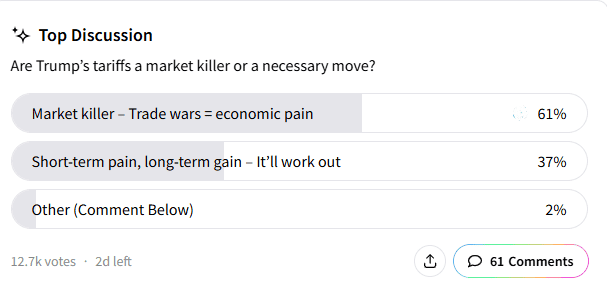

An ongoing Stocktwits poll that has so far collected responses from 12,600 users found that a majority (61%) view the tariff as a “market killer,” potentially leading to trade wars and more economic pain. A far less 37% said it could cause near-term pain but is a gain in the long run.

The QQQ ETF, which tracks the performance of the Nasdaq 100 Index, comprising 100 of the largest non-financial tech stocks, traded down about 1.24% at $490.95.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Box Stock Slips Ahead Of Q4 Print Due After Tuesday’s Closing Bell: Retail Sentiment Soars

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)