Advertisement|Remove ads.

Stocktwits Poll: Retail Sees 30% Or More Gains For Uber Stock In 2025 — But Chart Signals Key Hurdle Ahead

Shares of ride-hailing firm Uber Technologies (UBER) have gained over 8% since the beginning of 2025, but retail investors on Stocktwits believe more gains will be in store for the rest of the year.

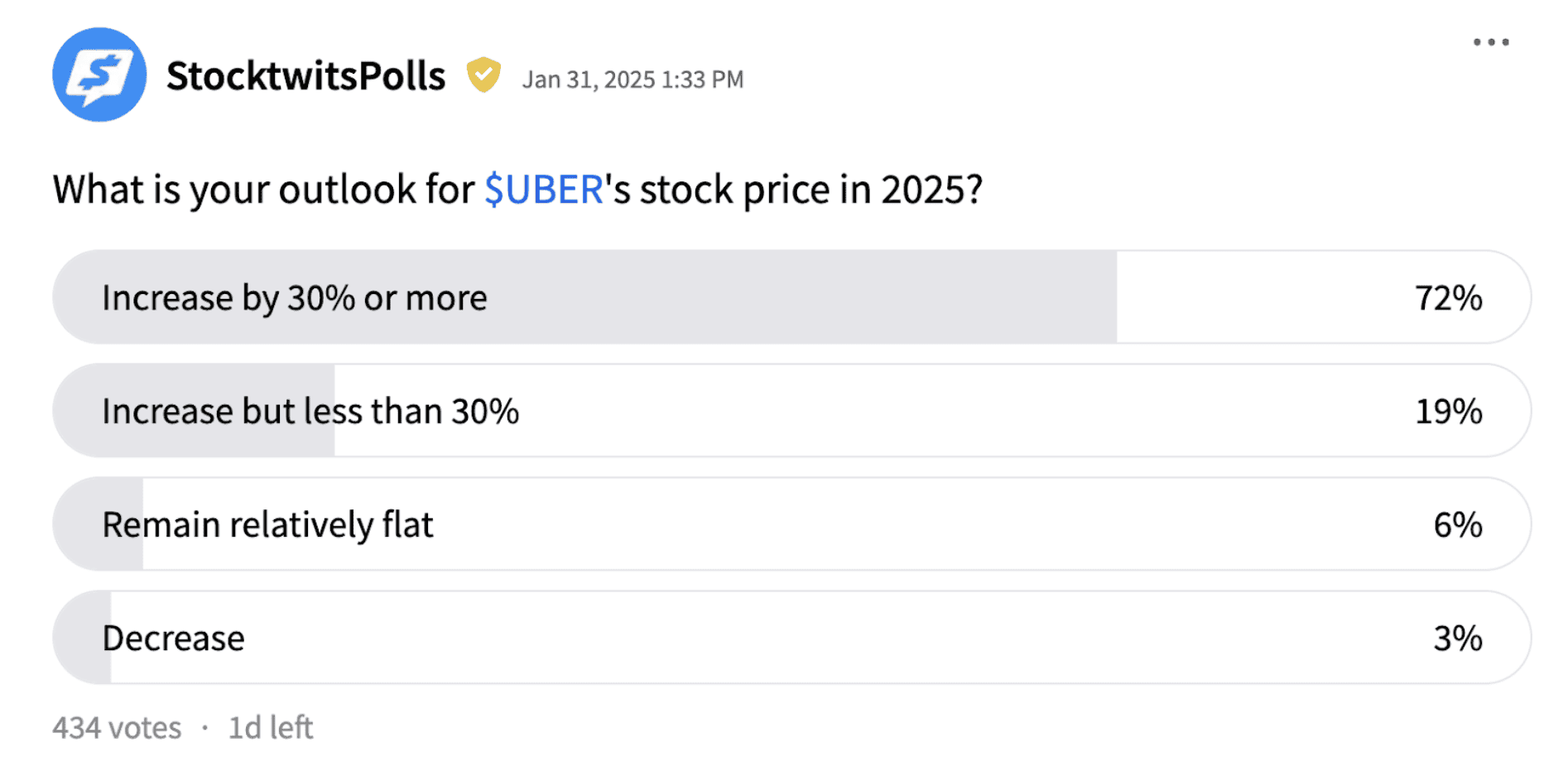

According to a poll by Stocktwits, more than 72% of the respondents believe Uber stock will gain 30% or more in 2025. Nineteen percent of the respondents believe the stock will rise, but the gains will be capped below 30%.

Only 6% of the poll participants believe the stock will remain flat, while 3% expect losses.

Uber is scheduled to announce its fourth-quarter earnings before the bell on Wednesday. Wall Street expects the firm to report earnings per share (EPS) of $0.5 on revenue of $11.79 billion.

Despite the positive outlook by retail investors, Uber’s chart patterns do not look too encouraging.

Uber’s stock closed near the $60 mark at the end of December 2024. For the shares to gain 30% in 2025, they must hit the $78 mark—a level significantly above its 200-day simple moving average.

However, since the beginning of December 2024, the stock has never traded above its 200-day simple moving average.

Recently, Bank of America analyst Justin Post lowered the firm's price target on Uber to $93 from $96 while keeping a ‘Buy’ rating on the shares. According to The Fly, the analyst believes Uber’s current valuation "seems to reflect a big autonomous vehicle (AV) overhang.”

The analyst also sees an opportunity for multiple expansions based on steady growth and margin improvement in 2025, coupled with a "stable-to-improving" autonomous vehicle narrative.

Meanwhile, Piper Sandler lowered the firm's price target on Uber to $82 from $98 while keeping an ‘Overweight’ rating on the shares.

On Stocktwits, most comments by retail investors reflect a positive take on the stock.

Also See: Cboe Global Markets Plans 24x5 Trading For US Equities: But Retail’s Cautious Ahead Of Earnings

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)