Advertisement. Remove ads.

IDT, Oracle, Scholar Rock: Retail Investors Turn Most Bearish On These Stocks

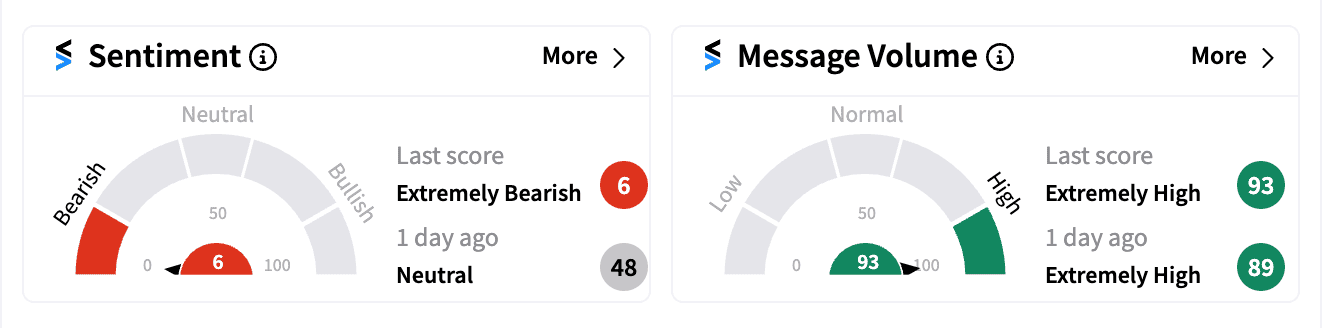

IDT Corp. ($IDT)

Shares of communications and payment services provider IDT Corp. surged nearly 20% on Wednesday following a positive earnings report that showed solid year-over-year revenue growth.

However, the company’s NRS subsidiary posted just a 2.2% year-over-year increase in same-store sales growth for September and a 1.3% drop compared to August, which tempered retail enthusiasm.

Despite the stock’s gains, retail sentiment on Stocktwits was ‘extremely bearish’ (6/100) as of 1:30 p.m. ET.

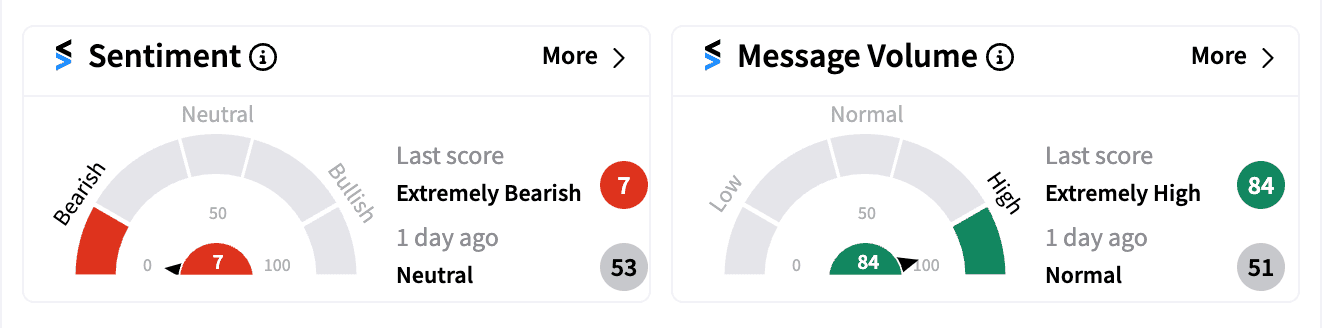

Oracle Corp. ($ORCL)

Oracle shares rose nearly 2% on Wednesday after announcing new AI-powered features within Oracle Fusion Cloud Service, aimed at improving customer service efficiency.

Retail sentiment on Stocktwits was ‘extremely bearish’ (7/100), with many investors concerned the stock remains overpriced amid the broader AI hype. Oracle’s trailing 12-month P/E ratio stands at 44.8, raising valuation concerns.

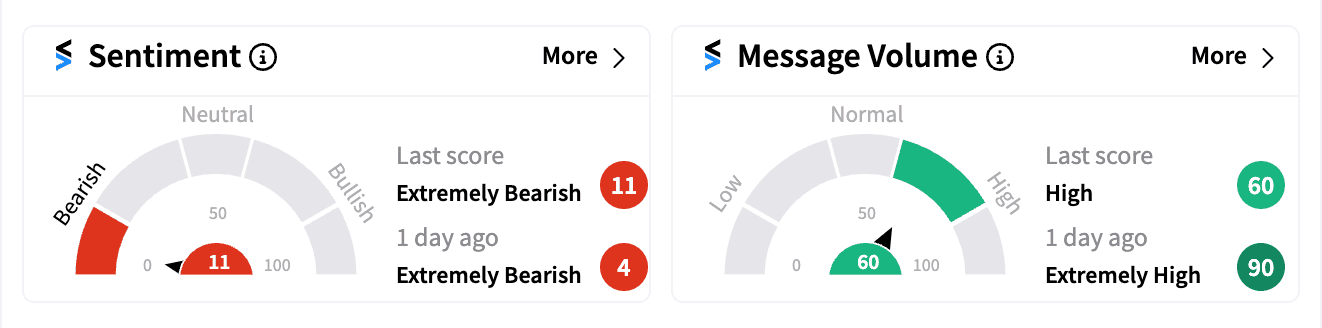

Scholar Rock Holding Corp. ($SRRK)

Shares of biotech firm Scholar Rock dropped over 4% on Wednesday after the company announced the pricing of an upsized $300 million public offering of common stock and pre-funded warrants at $28.25 per share.

This news follows a recent breakthrough in the Phase 3 trial of apitegromab, aimed at treating spinal muscular atrophy (SMA).

On Stocktwits, retail sentiment was ‘extremely bearish’ (11/100), though it slightly improved from the previous day.

Read next: Norwegian Cruise, Carnival Corp Stocks Rise On Citi’s Note: Retail Sails On Extremely Bullish Waters

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitmain_OG_jpg_96fc3b1d53.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1689521184_jpg_e3af4b0503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kotak_bank_resized_jpg_449c788c9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209252202_jpg_c5858a6a72.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)