Advertisement|Remove ads.

Stoneco Stock Rises After-Hours On Upbeat Q4 Revenue, Retail Pins Hopes On Long-term Growth

Stoneco (STNE) stock jumped 10.2% in after-hours trading on Tuesday after the financial technology firm topped estimates for quarterly revenue.

The company, which operates in Brazil, posted fourth-quarter revenue of 3.61 billion real ($637.1 million), while analysts expected it to post 3.58 billion real, according to FinChat data.

Stoneco said the 11.1% revenue rise was driven by higher financial services segment revenue, primarily due to growth in its active client base and improved client monetization.

Its adjusted net income rose to 665.6 million real, or 2.26 real per share, for the fourth quarter, compared to 563.8 million real, or 1.80 real per share, in the year-ago quarter.

The company’s total payments volume (TPV), which signifies the total value of processed transactions in its platforms, rose 16% to 143.9 billion real compared to a year earlier.

The rise was attributable to a 21% jump in micro and small business (MSMB) TPV, with PIX QR code volumes surging to 16.9 billion reals.

MSMB active payment clients were 4.1 million, an 18.8% rise from a year earlier.

Its banking active client base rose to 3.06 million, a 46.6% increase from the year-ago quarter, aided by continued expansion of its active payments client base.

“We should prepare for a tough 2025, as projected higher long-term interest rates are expected to impact economic activity,” CEO Pedro Zinner said.

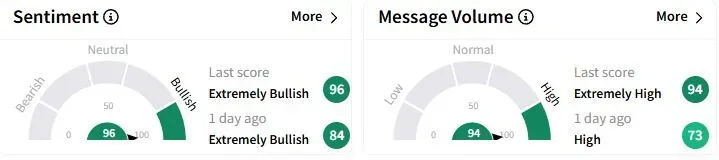

Retail sentiment on Stocktwits moved higher into the ‘extremely bullish’ (96/100) territory than a day ago, while retail chatter remained surged to ‘extremely high.’

One user said that if the company successfully hits its 2027 targets and the Brazilian currency does not get “clobbered”, the stock is “dirt cheap” at current valuations.

Another retail trader said that if Brazilian interest rates drop to 6% to 7%, the company would be “just printing money.”

Stoneco shares have gained 23.6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_target_logo_resized_jpg_3025bd9bb0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)