Advertisement|Remove ads.

Strategy Scoops Up 8,000 BTC Amid Crypto Market Weakness – Records Largest Purchase Since July

- MSTR’s latest buy brings its total Bitcoin holdings to 649,870.

- Filing shows most of Strategy’s latest purchases were funded by a euro-denominated preferred offering.

- Debate continues over the company’s “BTC yield” metric and how it should be interpreted by investors.

Strategy (MSTR) announced on Monday that it purchased more than 8,000 Bitcoin (BTC) over the past week as the cryptocurrency’s price fell below $100,000.

This purchase represents the company’s largest Bitcoin acquisition since July, when it bought 21,021 BTC. During September and October, Strategy mostly executed smaller, three-digit Bitcoin purchases.

MSTR’s stock fell as much as 2.8% in morning trade, but retail sentiment on Stocktwits trended in ‘bullish’ territory amid ‘high’ levels of chatter over the past day. Meanwhile, Bitcoin’s price fell 0.9% in the last 24 hours, trading at around $93,600. Retail sentiment around the apex cryptocurrency trend is in ‘bearish’ territory even as chatter was at ‘high’ levels.

Strategy Buys ‘A Lot’ Of BTC

The company said it had acquired 8,178 Bitcoin for $835.6 million, bringing its total Bitcoin holdings to 649,870. Strategy’s most recent purchase was made at an average price of $102,171 per Bitcoin.

Its filing with the Securities and Exchange Commission (SEC) showed that the majority of the purchases were made using proceeds from its euro-denominated preferred offering that closed last week.

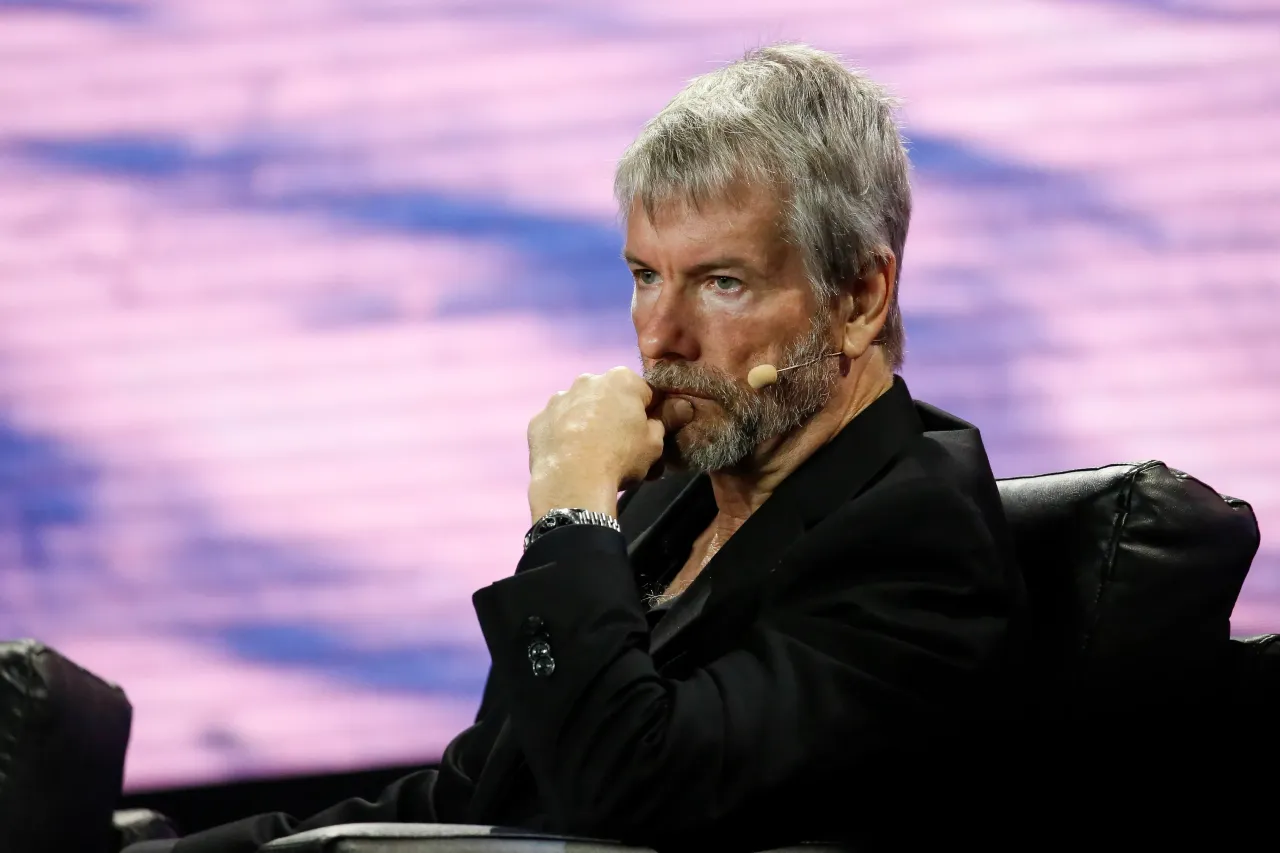

Executive chairman Michael Saylor had teased that the company is buying “a lot” of Bitcoin on Friday in an interview with CNBC. “We are buying. We're buying quite a lot, actually,” he said. “In fact, we've been accelerating our purchases.”

MSTR Stock Price Struggles

Saylor has also compared Strategy’s gains to those of Nvidia (NVDA), stating that both stocks have performed similarly over the past five years. While Nvidia’s stock has gained 1,315%, Strategy’s shares are up 951% since November 2020.

However, over the past 12 months, MSTR’s stock has declined by more than 43%, while NVDA’s stock has increased by around 33%. Most of the MSTR’s loss has come over the past month as Bitcoin’s price dipped from its all-time high of more than $126,000 in October to levels under $100,000. Investors are also concerned that the company’s mNAV metrics, which value its Bitcoin holdings in relation to its market capitalization, may dip below 1.

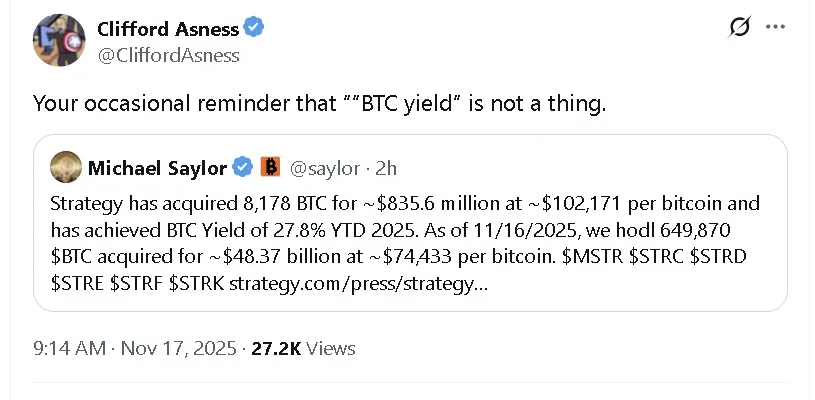

Cliff Asness, co-founder of AQR Capital Management, told investors in a post on X that “BTC yield” is not “a thing,” responding to Saylor, who had highlighted a 27.8% ‘BTC yield’ for Strategy along with its latest Bitcoin purchase. The metric is meant to reflect how issuing equity and debt to acquire additional Bitcoin increases each share’s exposure to the company’s holdings.

However, Saylor has asserted that even if Bitcoin’s price were to fall by 80%, the company’s digital asset treasury strategy would remain intact.

Read also: Bitcoin Price Struggles While Crypto Liquidations Top $500 Million – Analyst Flags Retail Pressure

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)