Advertisement|Remove ads.

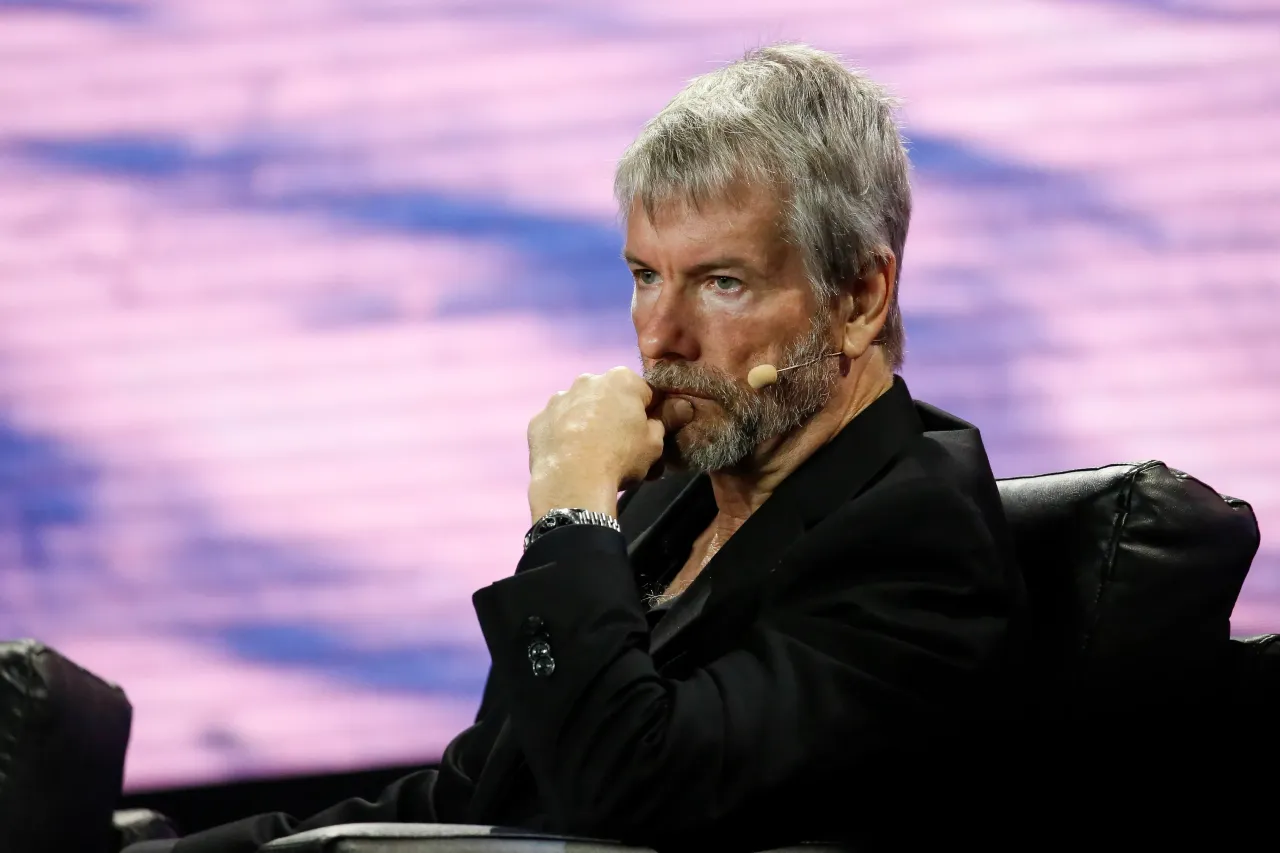

Bitcoin Dips To $95,000 – Michael Saylor Reportedly Says MSTR Is ‘Buying A Lot’

- MSTR stock dropped nearly 4% at market open, with retail sentiment declining from ‘bullish’ to ‘neutral’ territory on Stocktwits.

- Executive Chairman Michael Saylor stated that Strategy’s stock has performed similarly to Nvidia's over the last five years.

- He emphasized a four-year horizon for Bitcoin investors.

Bitcoin (BTC) slipped to $95,000 in morning trade on Friday, and Strategy (MSTR) is reportedly picking up “a lot” of the token for cheap, with numbers to be disclosed Monday.

People Will Be ‘Pleasantly Surprised’

“We are buying. We're buying quite a lot, actually,” executive chairman Michael Saylor told CNBC. “In fact, we've been accelerating our purchases.” Bitcoin’s price fell more than 6.6% in the last 24 hours and was the top trending ticker on Stocktwits. Retail sentiment around the apex cryptocurrency dipped to ‘bearish’ from ‘neutral’ territory even as chatter rose to ‘high’ from ‘normal’ levels over the past day.

Meanwhile, MSTR’s stock dipped 3.8% at market open and was also among the top trending tickers on Stocktwits. Retail sentiment around the shares dipped to ‘neutral’ from ‘bullish’ territory as chatter remained at ‘high’ levels over the past day.

“We'll actually report our next buys on Monday morning. I think people will be pleasantly surprised.”

– Michael Saylor, Executive Chairman, Strategy

Saylor compared Strategy’s gains to those of Nvidia (NVDA), stating that both stocks have performed similarly over the past five years. While Nvidia’s stock has gained 1,324%, Strategy’s shares are up 932% since November 2020.

However, over the past 12 months, MSTR’s stock has declined by more than 40%, while NVDA’s stock has increased by around 27%.

Four-Year Timeline For Bitcoin

Saylor stated that volatility comes with the territory and that “if you're going to be a Bitcoin investor, you need a four-year time horizon and must be prepared to handle the swings in this market.”

He added that Strategy now owns nearly 3.1% of the Bitcoin network, purchased at a blended average of around $74,000 per coin. Data from Arkham intelligence showed that MSTR moved more than 47,000 BTC to new wallets in the last 24 hours.

Regarding Bitcoin’s current price, Saylor said he feels “fairly comfortable” around the $95,000 level. He noted that leverage and liquidations have recently come out of the system and that older holders were selling at the $100,000 level. He expects the market to build from this base and rally, but said it is difficult to make a year-end prediction for Bitcoin’s price.

Saylor said that Strategy is only lightly leveraged, with debt due in four and a half years, and hence the company has no near-term financial pressures. Even if Bitcoin were to drop 80%, the company would remain overcollateralized and its balance sheet would remain stable, he said.

Read also: MSTR Stock Falls 7% Pre-Market After Strategy Moves Over 47,000 BTC – But Michael Saylor Says ‘HODL’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)