Advertisement|Remove ads.

Bitcoin Price Struggles While Crypto Liquidations Top $500 Million – Analyst Flags Retail Pressure

- CryptoQuant data revealed a significant panic sell from smaller Bitcoin holders, resulting in a loss.

- XRP outperformed major tokens ahead of multiple ETF launches this week.

- Market sentiment on Stocktwits has shifted into ‘bearish’ territory for both Bitcoin and Ethereum.

Bitcoin’s (BTC) price hovered near $95,600 in early morning trade on Monday, after continued pressure from retail selling and persistent outflows from spot ETFs weighed down on the overall cryptocurrency market.

The broader market slipped about 1% over the past 24 hours, bringing total capitalization to $3.3 trillion. Roughly $530 million in positions were liquidated, including $398 million from long positions and $131 million from shorts. Bitcoin accounted for the largest share with $188 million in liquidations, followed by Ethereum (ETH) at $160 million, Solana (SOL) at $21 million and XRP at $13 million.

What Drove Bitcoin’s Price Lower?

Bitcoin’s price fell 0.7% in the last 24 hours, with retail sentiment on Stocktwits trending in ‘bearish’ territory and chatter at ‘high’ levels over the past day. Over the weekend, Bitcoin slid to an intraday low of $92,971.17, its weakest level since late April, before attempting a gradual recovery.

Data from CryptoQuant indicated significant retail-driven selling. On Friday, holders with less than 1 million BTC — typically newer participants — offloaded a net 148,241 BTC in a “panic sell.” The selling took place near $96,853, well below their estimated average buying price of $102,000 to $107,000.

It explained that although long-term holders (LTHs) were selling in the background, the reason Bitcoin’s price dropped sharply from $126,000 was that short-term holders panicked and sold.

XRP Edges Higher As ETF Demand Builds

Cardano’s price fell 2.4% in the last 24 hours, leading losses among the top 10 cryptocurrencies by market capitalization. On Stocktwits, retail sentiment dipped to ‘bearish’ from ‘neutral’ territory over the past day. Chatter remained at ‘normal’ levels.

ADA was followed by Tron (TRX), which fell 1.7% over the last 24 hours, meme token Dogecoin (DOGE), which dropped 1.5%, and Binance Coin (BNB), which was down 1.4%. Meanwhile, Ethereum’s price fell 1.1% in the last 24 hours, with retail sentiment trending in ‘bearish’ territory but chatter was at ‘normal’ levels over the past day.

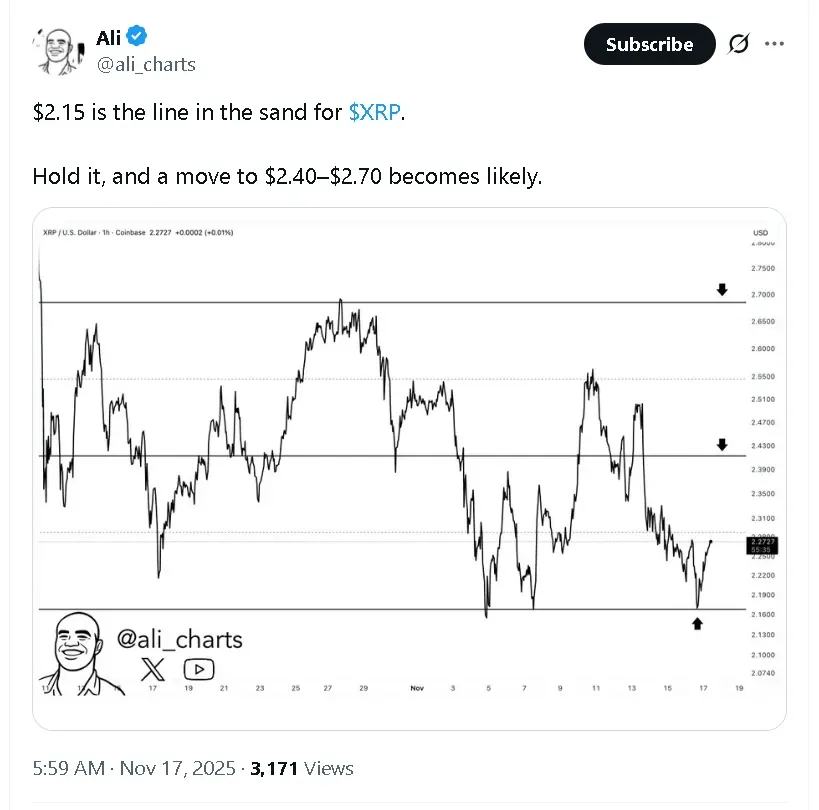

XRP’s price was the only one in the green, edging 0.1% higher in the last 24 hours. Retail sentiment around Ripple’s native token trended in ‘bullish’ territory with chatter at ‘high’ levels. According to an analysis by crypto trader Ali Charts, XRP’s key support stands at $2.15. “Hold it, and a move to $2.40 - $2.70 becomes likely,” he wrote on X.

The uptick and bullish sentiment come ahead of several ETF launches. Franklin Templeton will debut its XRP ETF (EZRP) on Tuesday, with Bitwise set to follow on Thursday. 21Shares plans to launch its own XRP ETF between November 21 and November 22, depending on final listing arrangements. Canary Capital’s spot XRP ETF (XRPC), which began trading on November 13, has already attracted $243 million despite broad market weakness.

Read also: Arthur Hayes Sells Nearly 1,500 Ethereum, Cuts DeFi Holdings Over The Weekend

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)