Advertisement|Remove ads.

Sunnova Stock Sees Surge In Retail Chatter After Unit Files For Bankruptcy Protection

Sunnova (NOVA) stock saw a 1366% jump in retail message volume on Monday after one of its units filed for bankruptcy protection at a Texas court.

According to the filing in the US Bankruptcy Court for the Southern District of Texas, the subsidiary, Sunnova TEP Developer, disclosed estimated liabilities of $100 million to $500 million.

According to Bloomberg and The Wall Street Journal, the company had been exploring ways to restructure its debt and considering a possible bankruptcy filing for weeks. In April, it missed interest payments on a bond.

As of Dec. 31, the company had a long-term net debt of $8.1 billion.

The outlook for solar energy has dimmed over the past few weeks, as President Donald Trump’s administration has moved to boost fossil fuel output and cut lucrative incentives for renewable energy.

In May, the Department of Energy terminated a $2.92 billion loan guarantee awarded to the firm during the Biden Presidency.

Sunnova has also been grappling with higher costs due to elevated interest rates and lukewarm demand in the residential solar market, which has been hit by the reduction of state incentives in key markets, such as California.

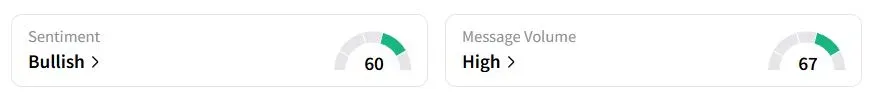

Retail sentiment on Stocktwits was in the ‘bullish’ (60/100) territory, while retail chatter was ‘high.’

One retail trader said short sellers were waiting for the company’s bankruptcy filing, but only got a filing by one of its units. The user also expected a green recovery with shorts closing their positions.

The company had a high short interest of 24.2%, according to Koyfin data.

Sunnova stock fell 8% on Monday. The stock has tumbled over 94% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)