Advertisement|Remove ads.

Sunrun, Costco Terminate Sales Partnership: Retail Stays Stoic Despite 3% Fall In Clean Energy Provider’s Stock

Sunrun (RUN) and Costco (COST) have mutually agreed to terminate their sales partnership, the home solar panel and battery storage company said on Thursday. Sunrun will wind down its lead generation activities in Costco warehouses no later than Dec. 31, 2024.

Shares of Sunrun fell over 3% on Thursday following the announcement while Costco shares were up over 1%.

Sunrun said that its clean energy subscription model provides less upfront revenue recognition under GAAP for Costco and thus, was not fully aligned with Costco’s financial objectives. The two firms were not able to reach mutually agreeable terms that would warrant continuation of the partnership long-term.

Sunrun said Costco currently represents less than 10% of Sunrun’s total volumes in the first half of 2024. The clean energy firm will be repositioning a significant portion of its sales staff in regions currently located in Costco stores to other retail partners and sales channels over time. This would include an expansion to Sunrun’s footprint across Lowe’s stores.

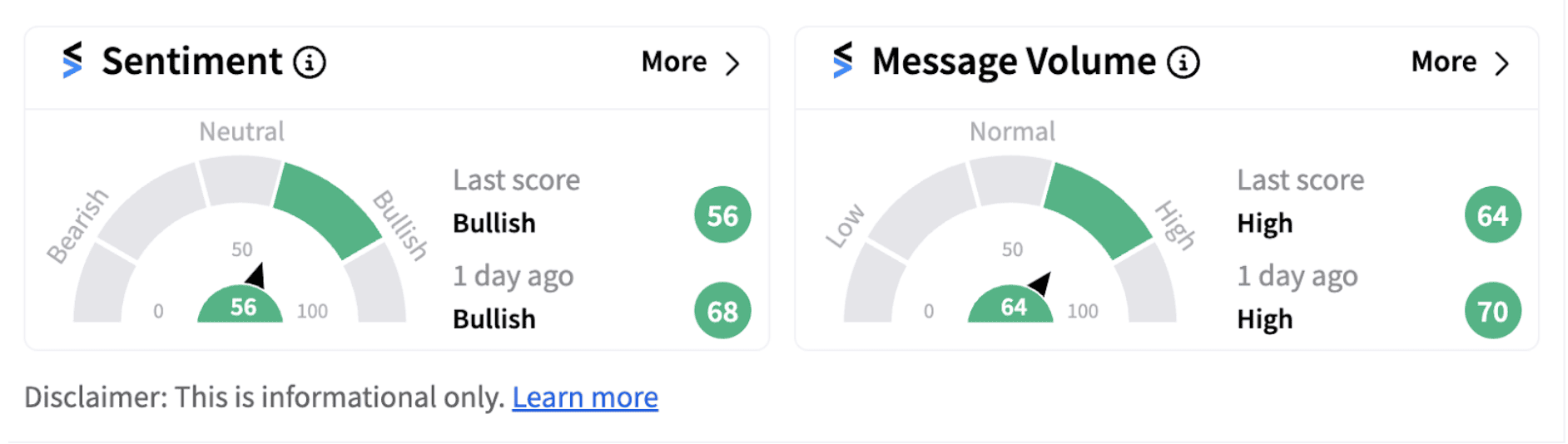

Stocktwits retail sentiment for Sunrun continued to trend in the ‘bullish’ territory (56/100), albeit with a lower score compared to a day ago.

Sunrun believes the changes will not have a material impact on the volume and cash generation projections previously shared during the second quarter earnings.

Notably, the rooftop solar industry has been going through some tough times given the high interest rate environment. Meanwhile, California, the biggest residential solar market, has reportedly reduced incentives for home systems.

Not surprisingly, Sunrun shares have not had a decent run, gaining just 0.69% so far this year. On the other hand, Costco shares have gained over 38% on a year-to-date basis.

Meanwhile, Truist Securities reportedly said it does not see any significant financial impact on Sunrun due to the termination of the sales partnership. The firm has a ‘Hold’ rating on the stock and a price target of $18.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213582854_jpg_830e44a354.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943683_jpg_d01763122d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1243243511_jpg_58a7a7cb8e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_electronic_arts_logo_resized_00d3d94fbb.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/09/reliance-power1-2024-09-89270e7a724a8c2241cdea69ee3b605f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/08/startup_funding1.jpg)