Advertisement|Remove ads.

Super Micro Stock In Spotlight As AI Server Maker Announces Major US Manufacturing Footprint Expansion: Retail Stays Upbeat

Artificial intelligence (AI) server maker Super Micro Computer, Inc. (SMCI) announced Friday, after the market closed, that it plans major expansion to its U.S. manufacturing footprint.

The proposed plan includes setting up a third campus in Silicon Valley, with the first building at 300,000 square feet. Once completed, the third campus will occupy up to 3 million square feet.

The San Jose, California-based company expects the expansion to help accelerate liquid-cooled and “Data Center Building Block Solutions,” while also creating new jobs and opportunities for local talent.

Charles Liang, CEO of Super Micro, said, “As AI factories become more prevalent, liquid-cooled data centers are critical to meet these increasing customer demands.”

He expects up to 30% of new data centers to adopt liquid cooling solutions. The latest expansion plans will help expand the company’s capacity from 5,000 air-cooled or 2,000 liquid-cooled racks per month.

San Jose Mayor Matt Mahan said, “With this planned expansion, Supermicro is helping San Jose redefine what 'Made in America' looks like and creating high paying new jobs to fuel our economy.”

Oakland, California-based utility company PG&E Corp. (PCG) would support Super Micro’s latest expansion.

Super Micro said construction at the new site will begin in 2025.

While issuing the second-quarter update in mid-February, Super Micro announced subpar preliminary second-quarter results and fiscal year 2025 guidance. However, the company guided 2026 revenue to a robust $40 billion.

One of the headwinds the company has faced over the last year is now in the rearview mirror. Last week, the company said it has filed its pending financial reports with the SEC and was current with all its reports, thus removing the risk of being delisted from the Nasdaq.

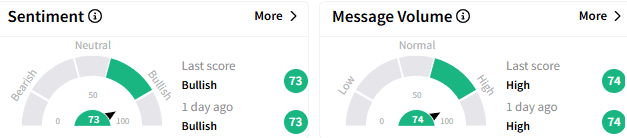

On Stocktwits, sentiment toward Super Micro stock remains ‘bullish’ (73/100) and the message volume also stayed ‘high.’

A bullish user said the 25% drop in the stock last week, despite regaining compliance without any restatements, did not make sense. They expect the stock to claw back those losses in the near term.

Another user expressed optimism over Super Micro’s capacity expansion even as rival AI server companies such as Dell (DELL) and HP, Inc. (HPQ) did not signal any such move.

Super Micro stock ended Friday’s session down 3.71% at $41.35, although it is up 36% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)