Advertisement|Remove ads.

Super Micro Stock Rises Premarket As Investors Focus On Positives From Mixed Q2 Business Update: Retail Rallies Behind AI Server Maker

Super Micro Computer, Inc. (SMCI) stock is poised for a solid rebound in Wednesday’s session. Investors cheered the artificial intelligence (AI) server maker’s strong 2026 revenue outlook even though the fiscal year 2025 second-quarter preliminary results proved lackluster.

The company also cut its 2025 revenue guidance and announced a $700 million privately-placed convertible debt offering. It also confirmed that it will get up to date with its annual and quarterly filings by Nasdaq’s Feb. 25 deadline

The San Jose, California-based company expects second-quarter non-GAAP earnings per share (EPS) of $0.58 to $0.60, up 5% from the year-ago period. This trailed the consensus estimate of $0.61, according to Yahoo Finance.

The company guided net sales in the range of $5.6 billion to $5.7 billion versus the $5.77 billion estimated by analysts.

GAAP and non-GAAP gross margin are estimated to range from 11.8% to 11.9%.

Super Micro said it expects $1.4 billion in cash and cash equivalents and $1.9 billion in debt as of Dec. 31, 2024. The debt comprises $0.2 billion in bank debt and $1.7 billion in convertible debt.

Founder and CEO Charles Liang said, “With our leading direct-liquid cooling (DLC) technology and over 30% of new data centers expected to adopt it in the next 12 months, Supermicro is well positioned to grow AI infrastructure design wins based on NVIDIA Blackwell and more.”

Looking ahead to the third quarter, the company guided non-GAAP EPS to $0.46-$0.62 and revenue to $5 billion-$6 billion.

Super Micro guided revenue of $23.5 billion to $25 billion for fiscal year 2025, down from the previous outlook of $26 billion to $30 billion. It expects 2026 revenue to be $40 billion.

On average, analysts estimate revenue of $24.2 billion and $33.58 billion for the upcoming fiscal years.

Super Micro also said it is working to file its fiscal year 2024 annual report on Form 10-K and the fiscal year 2025 first and second quarter reports on Form 10-Q by Feb. 25.

Separately, Super Micro said it has privately negotiated agreements with certain holders of its existing 0.00% convertible senior notes due 2029 to purchase $700 million aggregate principal amount of newly issued 2.25% convertible senior notes due 2028.

Interest on the new convertible notes is payable semi-annually on Jan. 15 and July 15. The conversion price will equal about a 50% premium over the volume-weighted average price of Super Micro common stock on Feb. 12, 2025.

On Stocktwits, Super Micro stock was among the top five trending and most active tickers.

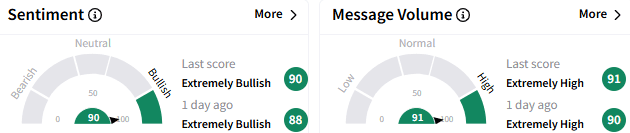

Retail sentiment toward Super Micro stock stayed ‘extremely bullish’ (91/100), with the optimism accompanied by ‘extremely high’ message volume.

A watcher said Super Micro is undervalued and, therefore, they would continue to accumulate shares.

Another user warned bears that they expect the stock to go up before the Feb. 25 deadline for filing the delayed financial reports.

In premarket trading, the stock climbed 6.60% to $41.16. It has added about 27% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)