Advertisement|Remove ads.

Sweetgreen Stock Dips On Price-Target Cuts Ahead of Q4 Earnings, But Retail’s Bullish

Shares of Sweetgreen Inc. ($SG) dropped more than 10% on Tuesday after the salad chain received price target cuts from analysts ahead of its fourth-quarter earnings, but retail sentiment stayed bullish.

Citi lowered the firm's price target to $43 from $49 with a ‘Buy’ rating as part of its Q4 earnings preview, Fly.com reported.

Sweetgreen will report earnings on Feb 26 after the market close. Wall Street analysts expect the company to post a loss per share of $0.21 on revenue of $162.8 million, according to Stocktwits data.

According to Citi, risks to Sweetgreen's Q4 and Q1-to-date same-store-sales come from "discrete events" such as holiday shifts, winter storms, and the wildfires, added the report. It expects the company’s management to give a conservative full-year guidance.

Weaker sales may additionally hamper the stock but continued performance from Infinite Kitchen will likely attract long-term investors who may see opportunity in a pullback, said the report.

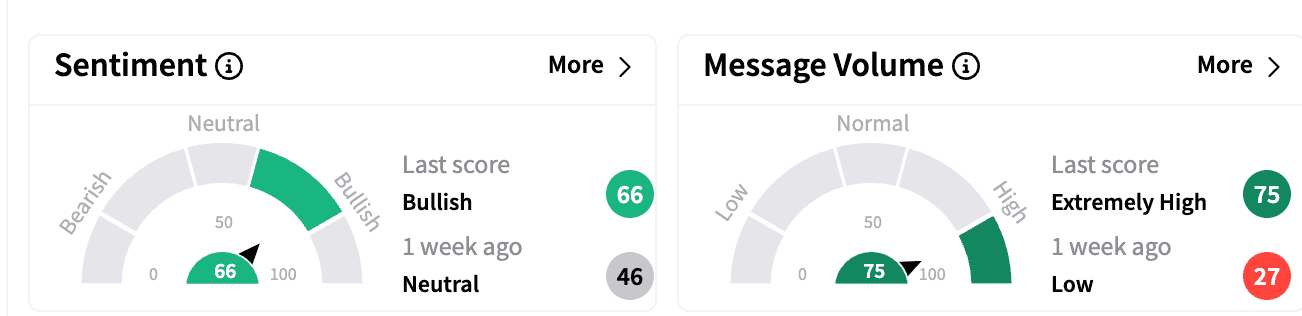

Sentiment on Stocktwits improved to ‘bullish’ from ‘neutral’ last week. Message volumes were in the ‘extremely high’ zone compared to ‘low.’

Recently, Morgan Stanley analyst Brian Harbour lowered the firm's price target to $28 from $32 with an ‘Equal Weight’ rating on the shares. According to the report, the analyst sees "reason for cautious optimism" for the restaurant sector in 2025 and models modestly better U.S. industry growth this year of almost 5%, compared to just over 4% last year, Fly.com reported, citing the analyst.

Sweetgreen owns and operates a chain of salad restaurants in over 240 locations across the U.S.

Sweetgreen stock is down 19% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)