Advertisement|Remove ads.

Symbotic Stock Dives 17% Pre-Market After Q1 Earnings Miss: Retail Eyes Bottom Fishing Opportunity

Automation technology company Symbotic Inc (SYM) shares traded over 17% lower in Thursday’s pre-market session after the first-quarter earnings fell short of Wall Street estimates.

The stock is on course for its worst day since November 2024.

Revenue rose 35% year-over-year to $486.69 million, but it was weaker than a Wall Street projection of $490.04 million. The growth was driven by solid progress across the company’s 44 systems in deployment.

CFO Carol Hibbard expects another quarter of at least 30% year-over-year revenue growth with expanding margins.

The company posted an earnings loss of $0.03 during the quarter versus an analyst estimate of an earnings per share of $0.03, according to FinChat data.

Net loss attributable to common stockholders widened to $3.47 million compared to a net loss of $2.84 million in the same quarter a year ago.

CEO Rick Cohen said that the firm continued to deliver high growth in the first quarter while enhancing its technology position.

“With our recent acquisition of Walmart’s Advanced Systems and Robotics business now completed, we look forward to enhancing an already strong position to drive exceptional results for our stakeholders,” he said.

Symbotic expects to post revenues of $510 million to $530 million and adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) of $26 million to $30 million during the second quarter (Q2) of 2025.

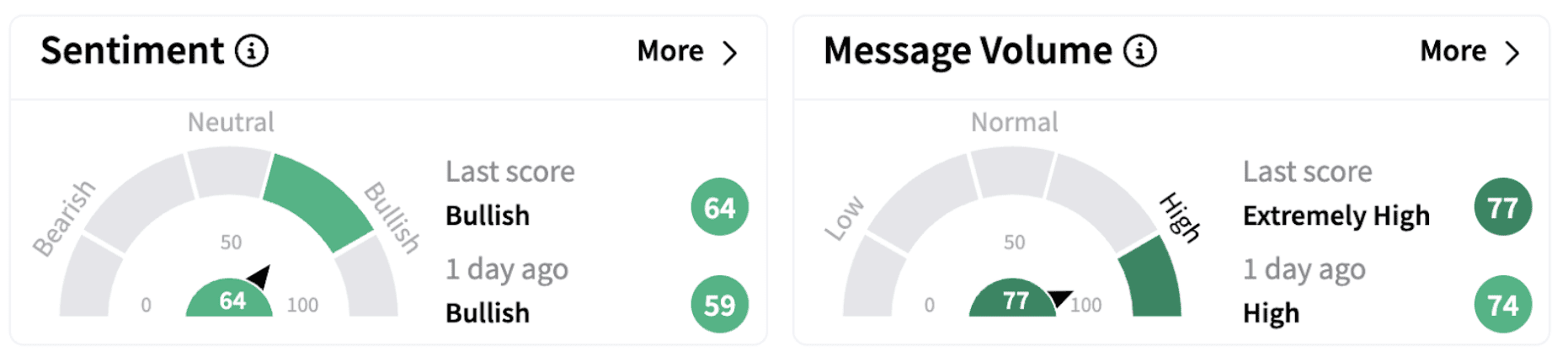

Following the earnings announcement, retail sentiment on Stocktwits climbed further into the ‘bullish’ territory (64/100), accompanied by significant retail chatter.

Meanwhile, Raymond James downgraded Symbotic to ‘Market Perform’ from ‘Outperform’ without a price target. According to The Fly, the analyst believes the company's Q1 results and Q2 guidance "missed the mark," along with a flat backlog and the slowing pace of system deployments.

Stocktwits retail chatter indicates that most investors view the stock positively and consider the current dip a potential buying opportunity.

SYM stock has gained over 25% in 2025 but is down over 18% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)