Advertisement|Remove ads.

Synaptics Stock Tumbles As Q2 View Misses The Mark, CEO Jumps Ship To Lumentum: Retail Gets More Bullish

Shares of Synaptics Inc. (SYNA) fell 13% in mid-day trade on Tuesday after the computer-to-human interface device development company announced its preliminary second-quarter results and the immediate exit of its president and CEO, Michael Hurlston.

Synaptics provided an update on its second-quarter performance, noting that it expects to post earnings per share (EPS) above its mid-point guidance of $0.85 and revenue of $267 million.

Stocktwits data shows the analyst consensus is an EPS of $0.86 and revenue of $265.73 million. This compares to an EPS of $0.57 and revenue of $237 million during the same period last year.

Stocktwits data also shows Synaptics has beaten EPS and revenue expectations for the past four quarters.

Hurlston has led the San Jose, California-based company since 2019. He will now take up the CEO role at Lumentum Holdings Inc. (LITE).

Shares of Lumentum were up more than 2.5% at the time of writing.

Synaptics said the search for Hurlston’s replacement has begun. In the meantime, CFO Ken Rizvi will serve as interim CEO.

“We are well positioned to continue delivering next-generation products and solutions to our customers and advancing our strategic goals,” said Nelson Chan, Synaptics’ chairman.

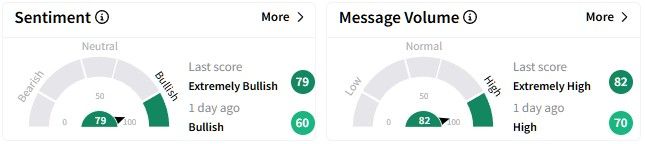

Retail sentiment on Stocktwits soared despite Hurlston’s exit, entering the ‘extremely bullish’ (79/100) territory from ‘bullish’ (60/100) a day ago. Message volume also surged to enter the ‘extremely high’ zone at the time of writing.

One user pointed out that Synaptics stock is “very oversold” while explaining their bullish outlook.

Synaptics’ share price has moved sideways over the past six months, gaining just 3.3%. However, its one-year performance is worse, with a decline of over 29%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)